"We find a passthrough effect of Pell Grants and subsidized loans on sticker price tuition of about 55 and 65 cents on the dollar, respectively."

This is obviously a vicious cycle where tuition subsidies beget higher tuition, which in turn leads to calls for even greater subsidies. This may be exactly what the Democrat party wants, but it's clearly not in the best interests of the public.

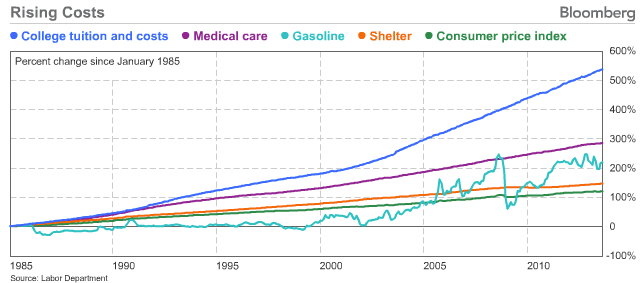

It is no coincidence that the product categories with the highest rates of price increases are the ones that are most heavily subsidize -- i.e. tuition and medical purchases.

No comments:

Post a Comment