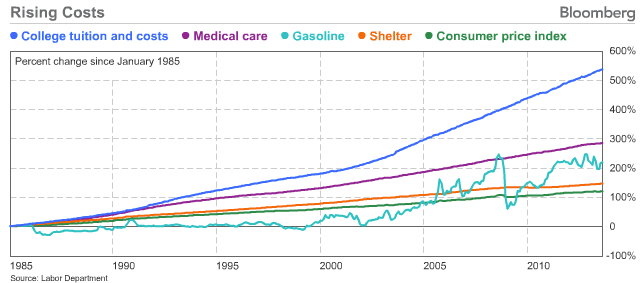

Now Grey Gordon and Aaron Hedlund at the National Bureau of Economic Research have published a paper Accounting for the Rise in College Tuition confirming the source of this stratospheric rise -- tuition subsidizes (sometimes called "financial aid"). Their conclusion:

"colleges respond to expansions of financial aid by increasing tuition. In fact, the tuition response completely crowds out any additional enrollment that the financial aid expansion would otherwise induce, resulting instead in an enrollment decline."

\

So in its usual perverse way, government distorts markets creating results that are exactly opposite to the ostensible goal.

Sound anything like what government did when it decided to increase home-ownership by subsidizing mortgages to buyers who were otherwise not qualified to obtain them? It should. Just as people were lured by mortgage subsidies to buy homes they really couldn't afford, lenders (in this case 90% government) lure young people to borrow money to pursue college degrees that many won't even achieve with the promise that college is a "sure thing" to a good job.

Bottom line: Owning a home and getting a college education are good things worth incurring debt for the right people who have a solid likelihood to repay. Government subsidies distort this equation such that all sorts of people who don't meet this requirement are enticed to borrow. People should be free to make bad decisions, but it's wrong for your government to actively enable them.

No comments:

Post a Comment