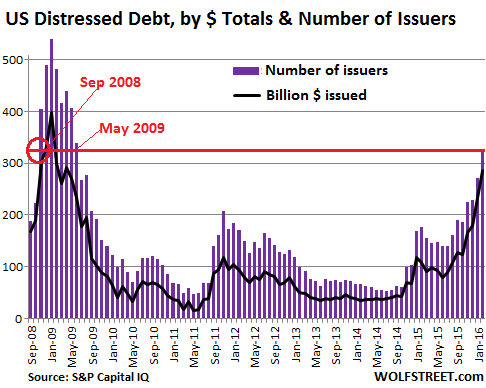

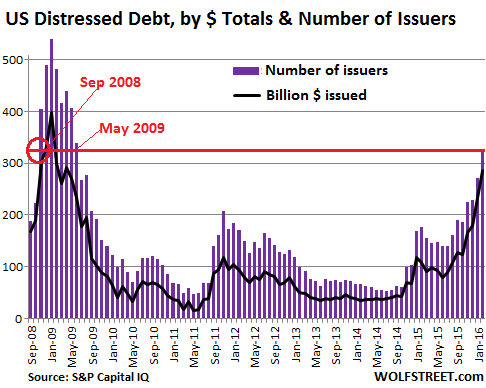

Distressed corporate debt (bonds whose yields are at least 10 points above Treasuries) have now reached the levels at the beginning of the 2008 financial crisis. This is the direct result of the Federal Reserve's near-zero interest rates which, predictably, encouraged blind risk taking. What does the Fed plan to do this time?

No comments:

Post a Comment