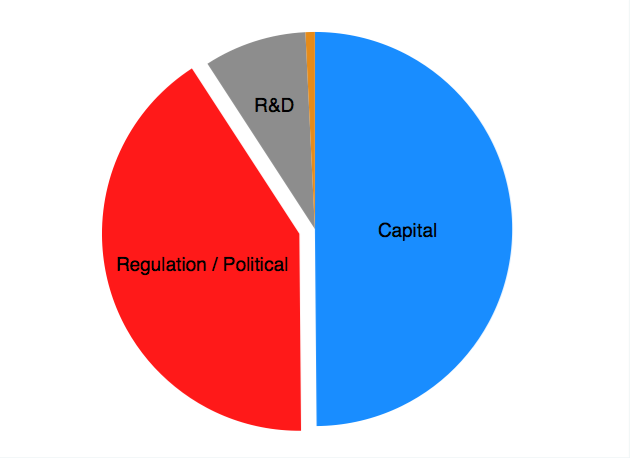

Jim Bessen from the Boston University School of Law recently published a new study providing evidence of this. In his study he estimates the regulation and other political activity accounts for about 40% of the increase in the rise of profits in the last 15 years.

Contribution to Rise in Operating Margins, 1971-2014, US public firms

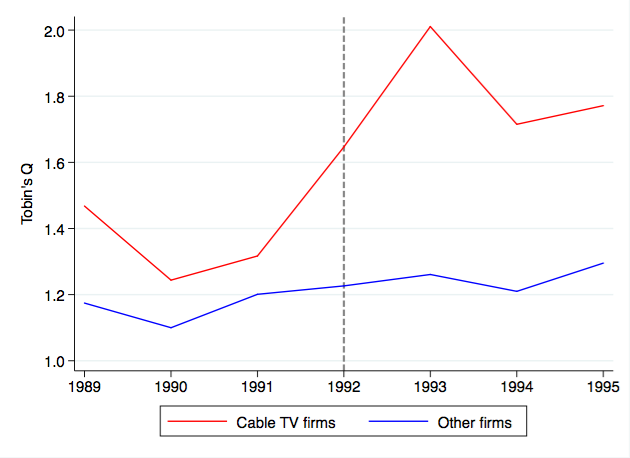

For large corporations today the most productive investment they can make is not in R&D or marketing or cost-reducing capital improvements, but in influencing government regulators to insulate them from new competition. In his paper, Bessen provides a striking specific example of effect of the laughably named* 1992 Cable Television Consumer Protection and Competition Act.

The act, of course, did nothing of the sort and predictably increased the relative value of cable firms.

Rise in Corporate Valuations / Assets around 1992 Cable Act;7 Cable TV firms and 2,137 other firms

So the next time you hear someone promising to "protect consumers" by regulating some business, remember that they are seeking just the opposite result.

* I am still struggling with whether the name of this act exceeds the Laughability Index of the Affordable Health Care Act. Pretty much a toss-up.

No comments:

Post a Comment