Saturday, December 16, 2017

It's The Economy (Again), Stupid

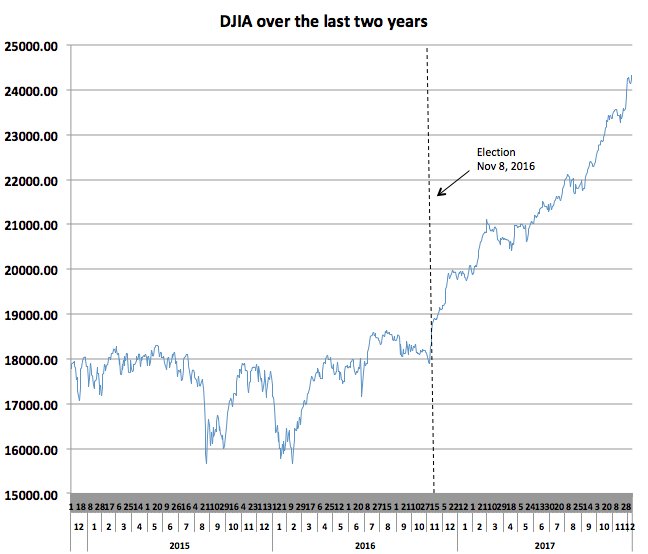

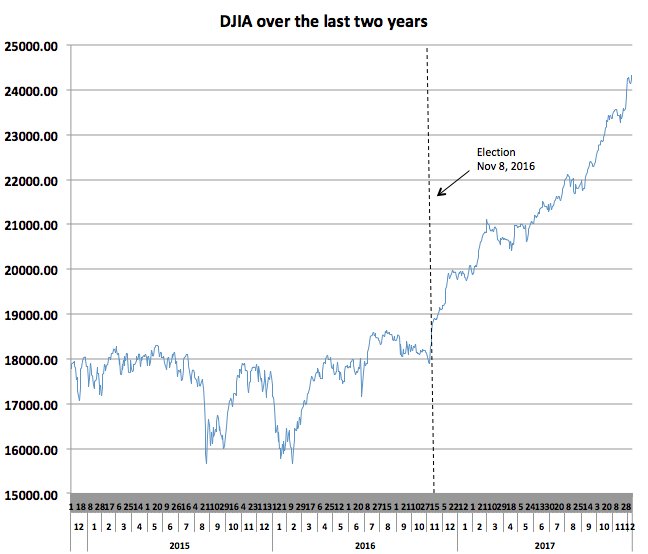

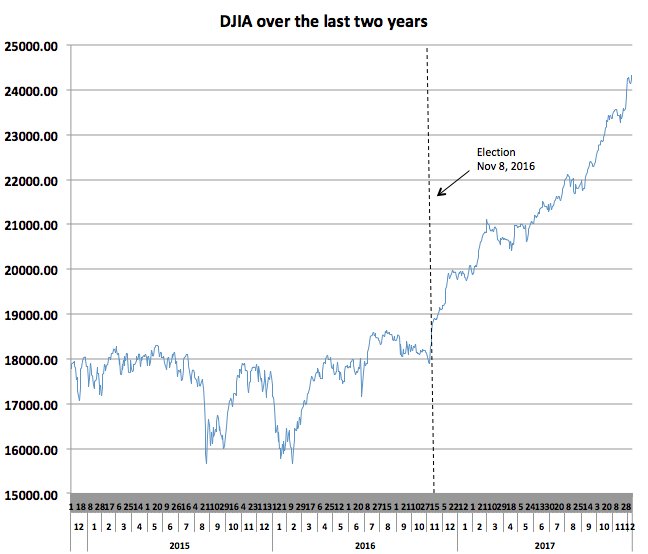

Presidents are seldom responsible for the performance of the stock markets, but this one is an exception. Market prices are always roughly reflect the present value of future income streams, the expectation of which ratcheted upward last November with the election of a President who promised, and appears to be delivering, lower taxes and regulation for businesses. Economic growth is driven by corporate profits and the reinvestment that devolves from those profits. We have experienced this twice before when President Kennedy and President Reagan cut tax rates. Democrats -- stuck with their Keynesian assumptions -- seem not to have learned this lesson. Or don't want to. It appears that they will come out in unanimous opposition to lower taxes and higher growth. A rather peculiar platform to run on. Maybe they ought to remember what James Carville said during the Clinton years -- it's the economy, stupid.

Wednesday, December 13, 2017

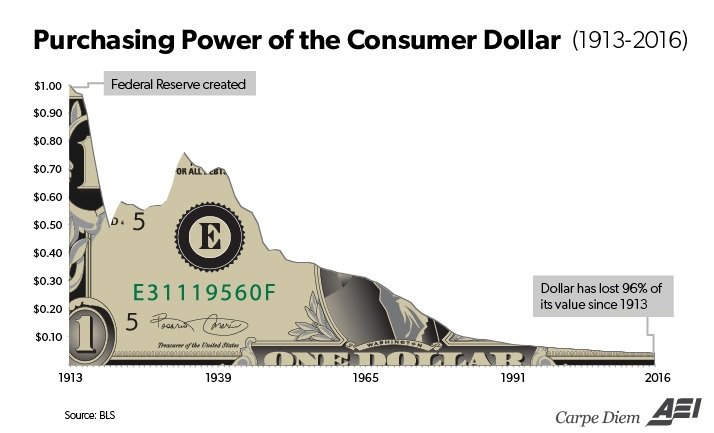

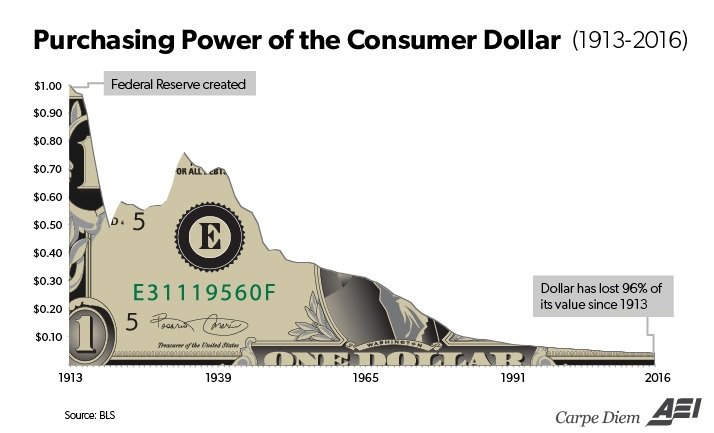

The Fed Is Worried About Bitcoin??

Takes quite a lot of Chutzpah for the Federal Reserve to claim it is worried about BitCoin losing it's value.

Monday, December 4, 2017

It's Hard to Cut the Taxes of Those Who Don't Pay Any

Wednesday, November 29, 2017

The Rich Are Not Paying Their Fair Share

Sunday, November 12, 2017

Millennials Prefer Communism. Really?

According to polling firm YouGov, Americans currently between the ages of 18 and 29 have a more favorable view of Communism/Socialism than they do of Capitalism.

Why? Below is a chart from 1991 showing GDP per capita in geographically matched countries. The ones on the left were, at the time, Communist economies. The ones on the right were capitalist economies.

Millennials would really rather live under a system that robs people of 90% of their economic well-being? Or maybe they just enjoy being surrounded by poor people?

Another possible explanation would be that Millennials are grossly ignorant having been successfully indoctrinated by leftist ideologues who run our schools.

Monday, October 30, 2017

CO2 Reduction Isn't Really a Goal, Is It?

Liberals say they want reduced CO2 emissions. But do they? If they did, they would be applauding the chart below. Why aren't they? Because all of this reduction was accomplished by the free market exploring new sources of inexpensive natural gas that replaced a lot of coal in electric production.

The truth is that CO2 reduction is not really their goal. Their goal is to make conventional energy sources more expensive so that they can more easily justify their Utopian schemes using wind and solar energy. And create a new source of taxation to fund these schemes.

The truth is that CO2 reduction is not really their goal. Their goal is to make conventional energy sources more expensive so that they can more easily justify their Utopian schemes using wind and solar energy. And create a new source of taxation to fund these schemes.

Friday, October 27, 2017

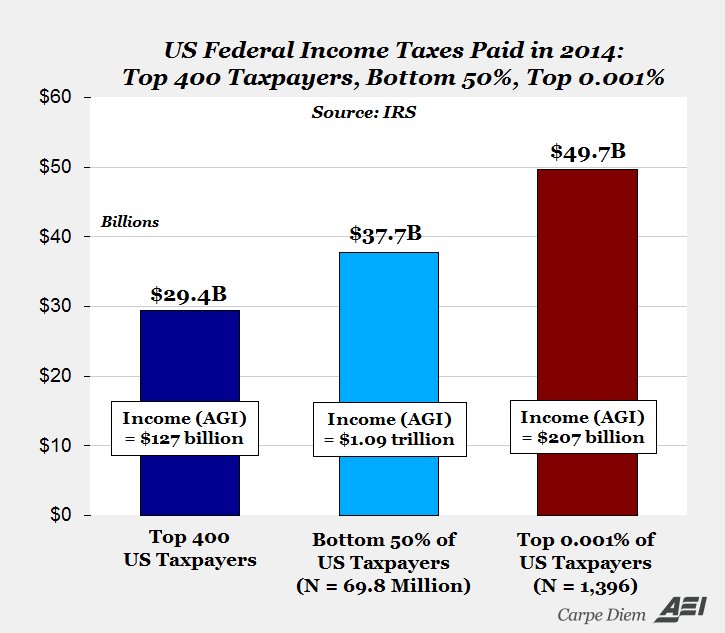

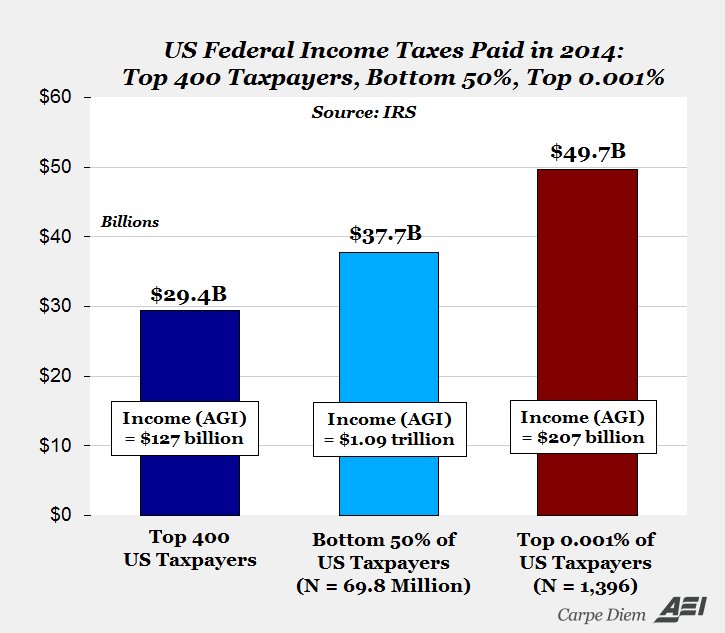

Fair Share of Taxes?

This chart from Professor Mark Perry.

1396 US taxpayers collectively paid far more income tax than 70 million Americans who paid the least tax.

And yet the constant drumbeat, "The Rich don't pay their fair share of taxes".

Darn right, it's not a Fair Share.

1396 US taxpayers collectively paid far more income tax than 70 million Americans who paid the least tax.

And yet the constant drumbeat, "The Rich don't pay their fair share of taxes".

Darn right, it's not a Fair Share.

Tuesday, October 24, 2017

Middle Class Tax Cuts

The mantra in Congress today is "tax cuts for the middle class" -- as if that hasn't been going on for over 30 years. But remember, never let facts get in the way of a good emotional argument.

Tuesday, October 17, 2017

Citizen United Hysteria vs. The Facts

Remember how Democrats screamed that the Supreme Court's Citizens United decision would "unleash a tidal wave of corporate spending that would wash away your voice"?

Below are the Top 20 contributors to Super PACs in the 2015-16 election cycle. Not one corporation. In fact among the Top 40 contributors there is only one corporation (and 8 unions).

Below are the Top 20 contributors to Super PACs in the 2015-16 election cycle. Not one corporation. In fact among the Top 40 contributors there is only one corporation (and 8 unions).

Friday, October 13, 2017

Economic Ignorance Encapsulated

I came across the chart below from the Cato Institute's Financial Regulation Survey.

It seems to me the perfect capture of the economic naiveté of the public. Anybody who has even a passing understanding of economics would understand making mortgages to more people with low credit qualifications will result in more defaults.

It wasn't in the study, but I'll bet you would get similar results for these questions:

Do you favor or oppose government raising the Minimum Wage?

Do you favor or oppose government raising the Minimum Wage if it meant there would be fewer jobs for low skilled workers?

Or maybe this one

Do you favor or oppose higher tariffs on goods from China?

Do you favor or oppose higher tariffs on goods from China if it resulted in higher prices for most things that you buy?

The illusion of a Free Lunch is still very powerful.

It seems to me the perfect capture of the economic naiveté of the public. Anybody who has even a passing understanding of economics would understand making mortgages to more people with low credit qualifications will result in more defaults.

It wasn't in the study, but I'll bet you would get similar results for these questions:

Do you favor or oppose government raising the Minimum Wage?

Do you favor or oppose government raising the Minimum Wage if it meant there would be fewer jobs for low skilled workers?

Or maybe this one

Do you favor or oppose higher tariffs on goods from China?

Do you favor or oppose higher tariffs on goods from China if it resulted in higher prices for most things that you buy?

The illusion of a Free Lunch is still very powerful.

Tuesday, October 3, 2017

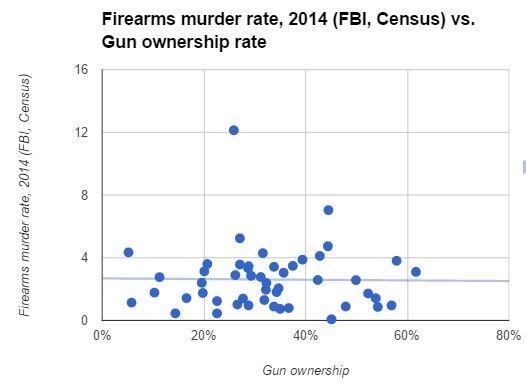

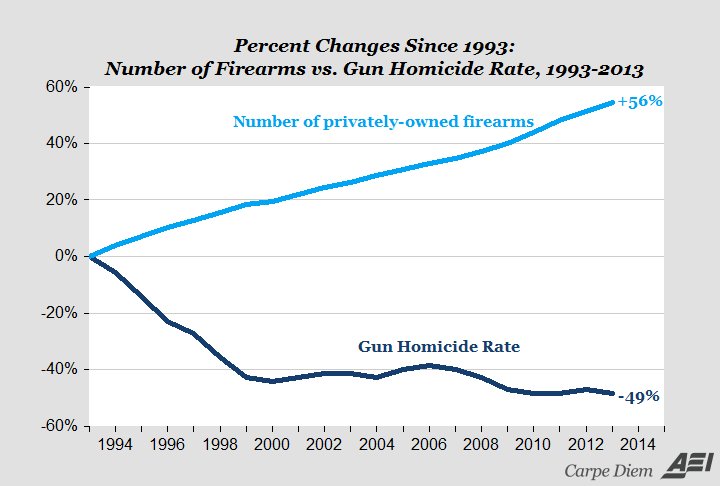

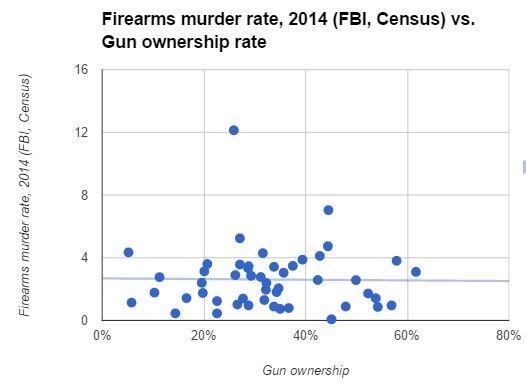

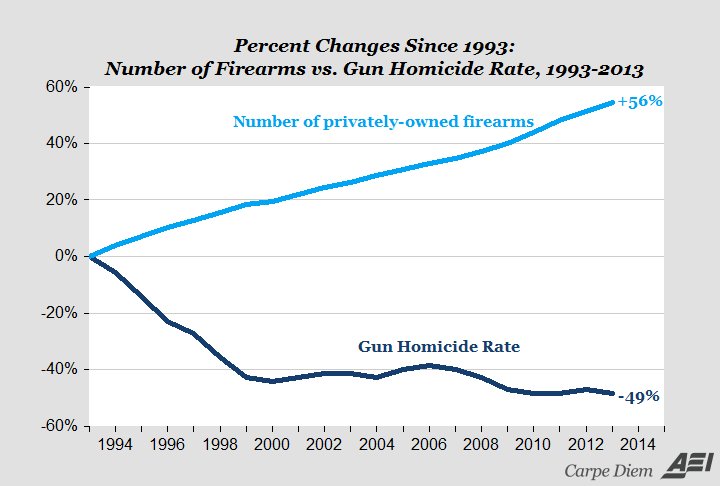

More Mindless Gun Control Hysteria

After the Las Vegas shootings we will once again have to endure the mindless calls for more gun control of some sort. My challenge is a simple one. If murders were related to gun ownership, wouldn't you expect to see a positive correlation between the two? Why would you advocate restricting the right to freely own guns simply to say you did something that has little likelihood of achieving your goal?

If you went to your boss and told him that you could make the company profitable if only he would fund big pay raises for the salesforce, do you think he would ask for empirical evidence to support that relationship? And if you couldn't provide that evidence, what do you think he should do?

If you went to your boss and told him that you could make the company profitable if only he would fund big pay raises for the salesforce, do you think he would ask for empirical evidence to support that relationship? And if you couldn't provide that evidence, what do you think he should do?

Wednesday, September 27, 2017

The Anticipation Effects of Business Regulation

Don Boudreaux at Café Hayek points out that minimum wage regulation has long term pernicious effects because businesses anticipate that government will constantly raise the wage floor above the market price. This means that the impact of the Seattle minimum wage is not only the difference between $15 and the current market wage, but also the anticipation that an anti-business city council will continue to raise that number in the future. In response to this, employers will today try to adjust their business models -- mainly though automation -- to accommodate not only today's wage, but the $20 or $30 that will surely come in a few years.

The Anticipation Effect extends well beyond wage floors. Just a couple of weeks ago Amazon made the decision to expand its headquarters outside the city of Seattle. They did this not only because of the anti-business actions the current city council has taken, but because it had become quite clear that they could expect a tsunami of onerous regulation in the future.

Businesses are forward thinking even if government is not.

The Anticipation Effect extends well beyond wage floors. Just a couple of weeks ago Amazon made the decision to expand its headquarters outside the city of Seattle. They did this not only because of the anti-business actions the current city council has taken, but because it had become quite clear that they could expect a tsunami of onerous regulation in the future.

Businesses are forward thinking even if government is not.

Tuesday, September 26, 2017

The Michigan Comeback

The table below is courtesy of the Wall Street Journal.

What do suppose changed in 2011 that didn't change in Illinois?

The date coincides with when Republicans took over the legislature and the governor's office. More directly it coincides with the reduction in both business and individual tax rates and enactment of the Michigan Right To work law.

So the lesson is pretty clear. If you want to keep your slow growth, you can keep on giving control to Democrats. That's what the people of Illinois apparently want. The people of Michigan opted instead to give control of the state to pro-growth Republicans.

What do suppose changed in 2011 that didn't change in Illinois?

The date coincides with when Republicans took over the legislature and the governor's office. More directly it coincides with the reduction in both business and individual tax rates and enactment of the Michigan Right To work law.

So the lesson is pretty clear. If you want to keep your slow growth, you can keep on giving control to Democrats. That's what the people of Illinois apparently want. The people of Michigan opted instead to give control of the state to pro-growth Republicans.

Monday, September 18, 2017

Income Growth for Married Couples

Wednesday, September 13, 2017

The Truth About Household Incomes

At the risk of bringing facts to an emotional fight with demagogues and the media, how exactly does one defend the notion (and it is just that) that median incomes in the country are falling?

Tuesday, September 12, 2017

Settled Science

The ”science is settled”. In 2015 we are told (97% consensus according

to the web site) that global warming is causing the Greenland ice sheet to

melt. Two years later we find out that the Greenland ice sheet is increasing.

I don’t know what that actually means, but I’m 97% certain

that “settled” isn’t part of it. At the moment I’m going to go with “don’t know

jack”.

Friday, September 8, 2017

Why Price Gouging Laws Are a Bad Idea (in one photo)

They say a picture is worth a thousand words.

For those who can't understand verbal explanations of why laws that prohibit "price gouging" are a really bad idea., try this picture.

Apparently the price of Aquafina wasn't high enough to motivate this woman to, say, fill up containers in her home with tap water. If the price could be doubled or tripled, even this lady might rethink that. As a result of laws prohibiting this sort of rational pricing behavior, the people who come into the store after her will be unable to buy bottles of water. But at least they'll be unable to buy them at regular prices. Right?

For those who can't understand verbal explanations of why laws that prohibit "price gouging" are a really bad idea., try this picture.

Apparently the price of Aquafina wasn't high enough to motivate this woman to, say, fill up containers in her home with tap water. If the price could be doubled or tripled, even this lady might rethink that. As a result of laws prohibiting this sort of rational pricing behavior, the people who come into the store after her will be unable to buy bottles of water. But at least they'll be unable to buy them at regular prices. Right?

Tuesday, August 15, 2017

It's All About the Children, Right?

Percent change since 1950

Students +100%

Teachers +240%

Administrative Staff +695%

Spending per pupil +368%

Mean SAT score -10%

Students +100%

Teachers +240%

Administrative Staff +695%

Spending per pupil +368%

Mean SAT score -10%

Tuesday, August 8, 2017

You Don't Learn Logic in Journalism School

This article in the Seattle Times entitled "Seven tips to help you graduate from college in four years" demonstrates that they don't teach logic or statistical inference in journalism school (but ought to).

It may sound counterintuitive, but freshmen college students who take a full load of reasonably demanding courses are more likely to graduate from college on time.

That’s part of the message Western Washington University has been conveying to its students in a campaign called “15 to Finish,” which encourages students to work hard from the outset.

Why would it be counterintuitive? Because the author is committing the fallacy of Post hoc ergo propter hoc (Since event Y followed event X, event Y must have been caused by event X.) She observes that faster graduation rates follow demanding course loads and concludes that the course loads are what causes that.

Isn't it more likely that students who are innately ambitious and intent to graduate to get on with their lives are also innately more serious about academics -- i.e. interested in actually learning more on the way to their degree?

Ms Long labels herself a "higher education reporter". Perhaps it's time to go back to school?

It may sound counterintuitive, but freshmen college students who take a full load of reasonably demanding courses are more likely to graduate from college on time.

That’s part of the message Western Washington University has been conveying to its students in a campaign called “15 to Finish,” which encourages students to work hard from the outset.

Why would it be counterintuitive? Because the author is committing the fallacy of Post hoc ergo propter hoc (Since event Y followed event X, event Y must have been caused by event X.) She observes that faster graduation rates follow demanding course loads and concludes that the course loads are what causes that.

Isn't it more likely that students who are innately ambitious and intent to graduate to get on with their lives are also innately more serious about academics -- i.e. interested in actually learning more on the way to their degree?

Ms Long labels herself a "higher education reporter". Perhaps it's time to go back to school?

The Power of Compound Growth

You've heard this advice: Start saving early for your retirement. Consider this example. Investor B opens an IRA at age 19. For seven consecutive years he puts $2,000 in his IRA at an average growth rate of 10% (7% interest plus

growth). After seven years this investor makes NO MORE contributions -- he's

finished.

A second investor A makes no contributions until age 26 (this is the age when investor B was finished with his contributions). Then A continues faithfully to contribute $2,000 every year until he's 65 (at the same theoretical 10% rate).

Whos is better off? Check the chart below.

A second investor A makes no contributions until age 26 (this is the age when investor B was finished with his contributions). Then A continues faithfully to contribute $2,000 every year until he's 65 (at the same theoretical 10% rate).

Whos is better off? Check the chart below.

Tuesday, August 1, 2017

Climate Changing? Gender Inequality is the Culprit.

If you want to understand the irrational extent of climate change hysterics, read the Intergovernmental Panel on Climate Change report. Among the policy recommendations from this illustrious group of "scientists" are "reduced gender inequality & marginalization in other forms,” “provisioning of adequate housing,” and “cash transfers”. All scientifically proven ways to reduce the planet's temperature of course

Monday, July 10, 2017

It's Medicaid That's Out of Control

At every juncture in the discussion about reforming healthcare, Democrats and a few Republicans wail that you "can't cut Medicaid". Does this look like a program that has been subject to any cuts since it's inception? More importantly, how long can you sustain spending on something that is growing many times faster than the economy which must fund it?

Yes, honey, I know the kids deserve all sorts of nice things, but if our Visa bill is doubling every year and our income is going up by 5%, do you not see a problem? Are you expecting the Tooth Fairy to fix this for us?

Yes, honey, I know the kids deserve all sorts of nice things, but if our Visa bill is doubling every year and our income is going up by 5%, do you not see a problem? Are you expecting the Tooth Fairy to fix this for us?

Wednesday, July 5, 2017

Fleeing Fiscal Suicide

This is what happens when states pursue reckless financial practices and try to cover them up with onerous taxes on its most productive citizens. They move to states that appreciate them. Democrats have long supported assisted suicide. Now they're applying that to entire states.

Monday, July 3, 2017

Black Privilege

According

to data

derived from the 2014 federal budget, the average annual per capita "net contribution"

(taxes paid minus benefits received) breaks down by race as follows:

White: +$2,795 (on average pays more in taxes than receives in benefits)

Black: -$10,016 (on average receives more in benefits than

pays in taxes)

Over

the course of an average 79-year lifespan, a white individual would then average a net

contribution of $220,805, whereas over the course of an average 75-year

lifespan, a black individual receives a net benefit of $751,200.

One

can quibble about the precision of the data, but the magnitude is so lopsided,

you can’t really dispute the conclusion: The government acts in ways that results in transfers

of large amounts of wealth from white people to black people.

It would

appear that reparations are already in place.

Thursday, June 29, 2017

The Economic Road to Perdition: Healthcare & Minimum Wage

Perhaps for policy reasons, and

certainly for political reasons, it is impossible to unwind reliance on

employer-provided insurance. But this fact, combined with the “preexisting

conditions” consensus, means that henceforth the health-care debate will be

about not whether there will be a thick fabric of government subsidies,

mandates and regulations, but about which party will weave the fabric.

This is the frustrating essence of the current debate about the GOP healthcare bill. Once you concede that government should be involved in running healthcare, you are then reduced to arguing about which forms of intrusion are the least harmful. Clearly Obamacare has been horribly harmful. Arguably the GOP alternative is less harmful. But either way you are on the road to economic perdition and have abandoned the principle that systems work best when individuals are allowed to make free choices.

The same reasoning applies to the battles over Minimum Wage laws. Once you concede that government should be involved in setting prices for things, you are reduced to arguing about the amount of damage various forms of intrusion incur. In 1971, President Richard Nixon declared a "freeze" on all prices and wages in the United States. This was an attempt by government to control the inflation that it itself had created. Predictably, it ended disastrously. Minimum wage laws have been around in the US since 1938. The economic effect of any price floor is to create a supply surplus. If you set a minimum price for lemons you will have a surplus of unsold lemons. If you set a price floor for wages, you will have a surplus of labor, otherwise known as unemployment. The Law of Demand is not widely debated -- except when it conflicts with Utopian fantasies.

Until recently Minimum Wage laws have not been especial controversial, but only because the price floors have been set not too far above the market price for low skilled labor. Hence the unemployment surplus has not been terribly noticeable. Now comes along the Seattle City Clowncil to declare that the wage floor rise should increase by 60%. Suddenly the unemployment surplus becomes quite noticeable, making headlines all over the country.

It would be nice if we could recognize that a) government cannot control the price of anything whether it be wages or medical care and b) in trying to do so it will wreak economic damage, the amount of which will vary according to just how far from economic reality it has strayed. But we won't. The (rather spineless) GOP has given up on having that discussion. They are now engaged in the determination of just how much economic damage they are willing to impose on the country. Obamacare was too much. Their plan is just the right amount of damage -- they contend. Seattle's Minimum Wage law was clearly too aggressive. Let's scale it back and have a smaller number of low-skilled workers be priced out of a job.

Are we left to arguing that the only thing problematic about heroin is if you inject a little too much of it?

Wednesday, June 28, 2017

Fantasy Baseball League

I've decided that baseball would be better off operating more like our public schools. Here are some of the changes I'd make:

- Players could no longer be cut or sent to the minors for poor performance. As long as they show up for every game and practice they would be paid.

- Player salaries would be determined by how many years they had played for the team, not based on any performance statistics.

- Players who exhibited performance-oriented behaviors (like trying to steal a base or diving for a fly ball) would be ostracized by the other players on the team.

- Every call by the umpires would be reviewed by The Commissioner the next day. Scores would be revised based on his ruling.

- There would be lots of promotional nights and giveaways. Examples: Indigenous People's Night. Gay Pride Night. Free tofu hot dog night. Fan Appreciation Night where everybody in attendance gets a trophy for showing up.

- Fans would not be allowed to boo or disparage the players or managers. Violators will be ejected and sent to reeducation classes.

Now, just in case too few people would voluntarily pay to watch games, we would require everyone who lived in the market area to buy a season ticket -- whether they attended games or not. If you wanted to buy tickets to watch an out-of-town team, you could, but you would still have to pay for your season ticket. And in order to increase the salaries of the players and managers we would be raising ticket prices each year. Any sportswriter who questioned the team's record would be told it could be improved by raising ticket prices and expanding the roster.

In the spirit of community cooperation, I ask all of you to support me in this effort. If you don't, I will have a couple representatives of the players union pay a visit to your home to explain.

Friday, June 23, 2017

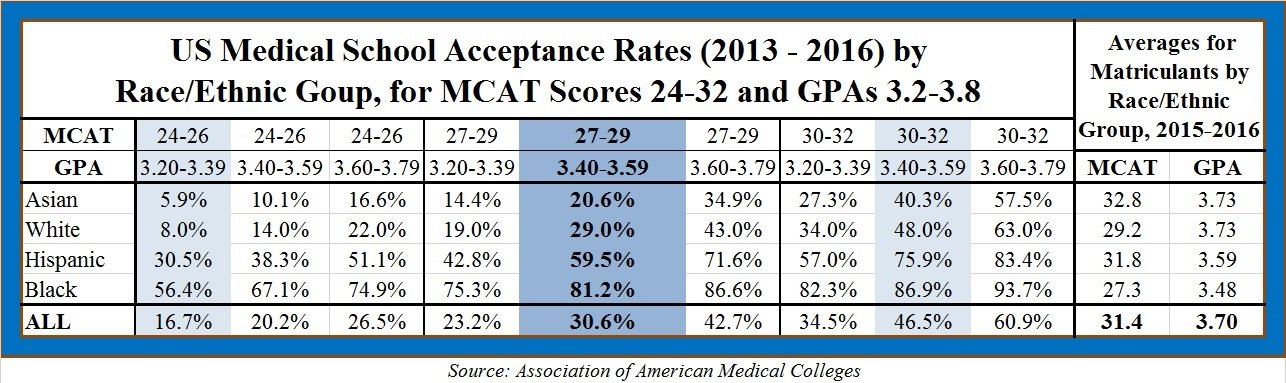

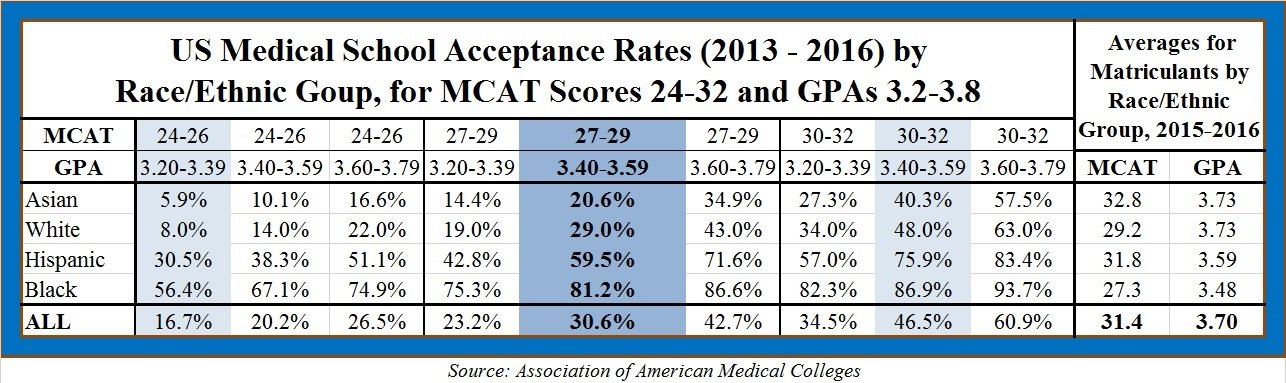

Black Privilege

Apparently there's Black Privilege, too. And think about this the next time you see a black doctor.

Wednesday, June 21, 2017

San Diego Restaurant Jobs and the Law of Demand

Does anyone (yes, even you Democrats) think this is just a coincidence? It's too bad that there isn't something that would have predicted this. Something, oh, like the Law of Demand.

The Law of Demand states that, all else being equal, as the price of something increases, quantity demanded falls. Could it get any simpler for the simple-minded?

The Law of Demand states that, all else being equal, as the price of something increases, quantity demanded falls. Could it get any simpler for the simple-minded?

Bee-pocalypse and Other Media-Made Disasters

Remember the media hysteria about bees? In 2006, beekeepers began reporting mysteriously large losses to their honeybee hives over the winter. The media swiftly declared a disaster. Time called it a “bee-pocalypse”. Government must DO SOMETHING to stop this or bees will become extinct! The only thing missing was an international meeting in Paris to establish a Bee-cord. If you guessed that the media attributed the imagined bee-pocalypse to global warming, you'd be correct. Right up there with the myth about polar bear populations dwindling).

Data thanks to Mark Perry at AEI

Data thanks to Mark Perry at AEI

Monday, June 5, 2017

The Cost of Federal Regulations

The Competitive Enterprise's annual report on Federal regulations puts the annual cost at just shy of $2 Trillion. That's 10% of the entire US gross domestic product. It also averages almost $15,000 per household. In calendar 2016 Congress enacted 214 laws and Federal agencies issued 3853 rules. That's 18 rules for every law enacted.

And you wonder why economic growth has slowed? And you wonder why people feel they're struggling to support a $15,000 hidden tax on them every year?

And you wonder why economic growth has slowed? And you wonder why people feel they're struggling to support a $15,000 hidden tax on them every year?

Wednesday, May 24, 2017

The Science is Settled?

The next time you hear the phrase "The Science is Settled" you might want to review this piece of previously "settled" science.

The history of human evolution has been rewritten after scientists discovered that Europe was the birthplace of mankind, not Africa.

Currently, most experts believe that our human lineage split from apes around seven million years ago in central Africa, where hominids remained for the next five million years before venturing further afield.

The discovery of the creature, named Graecopithecus freybergi, and nicknameded ‘El Graeco' by scientists, proves our ancestors were already starting to evolve in Europe 200,000 years before the earliest African hominid.

An international team of researchers say the findings entirely change the beginning of human history and place the last common ancestor of both chimpanzees and humans - the so-called Missing Link - in the Mediterranean region.

At that time climate change had turned Eastern Europe into an open savannah which forced apes to find new food sources, sparking a shift towards bipedalism, the researchers believe.

“This study changes the ideas related to the knowledge about the time and the place of the first steps of the humankind,” said Professor Nikolai Spassov from the Bulgarian Academy of Sciences.

“Graecopithecus is not an ape. He is a member of the tribe of hominins and the direct ancestor of homo.

“The food of the Graecopithecus was related to the rather dry and hard savannah vegetation, unlike that of the recent great apes which are living in forests. Therefore, like humans, he has wide molars and thick enamel.

The history of human evolution has been rewritten after scientists discovered that Europe was the birthplace of mankind, not Africa.

Currently, most experts believe that our human lineage split from apes around seven million years ago in central Africa, where hominids remained for the next five million years before venturing further afield.

But two fossils of an ape-like creature which had human-like teeth have been found in Bulgaria and Greece, dating to 7.2 million years ago.

An international team of researchers say the findings entirely change the beginning of human history and place the last common ancestor of both chimpanzees and humans - the so-called Missing Link - in the Mediterranean region.

At that time climate change had turned Eastern Europe into an open savannah which forced apes to find new food sources, sparking a shift towards bipedalism, the researchers believe.

“This study changes the ideas related to the knowledge about the time and the place of the first steps of the humankind,” said Professor Nikolai Spassov from the Bulgarian Academy of Sciences.

“Graecopithecus is not an ape. He is a member of the tribe of hominins and the direct ancestor of homo.

“The food of the Graecopithecus was related to the rather dry and hard savannah vegetation, unlike that of the recent great apes which are living in forests. Therefore, like humans, he has wide molars and thick enamel.

Tuesday, May 23, 2017

The Economic Costs of Restrictive Housing Practices

It is not unusual for cities to engage in restrictive housing practices that are designed to benefit existing property owners at the expense of new entrants. Restricting competition to benefit incumbents is pretty much what government does. However, a new study by

Chang-TaiHsieh of the University of Chicago seeks to quantify the cost of these anti-competitive practices -- and they appear to be huge.

We quantify the amount of spatial misallocation of labor across US cities and its aggregate costs. Misallocation arises because high productivity cities like New York and the San Francisco Bay Area have adopted stringent restrictions to new housing supply, effectively limiting the number of workers who have access to such high productivity. Using a spatial equilibrium model and data from 220 metropolitan areas we find that these constraints lowered aggregate US growth by more than 50% from 1964 to 2009.

You can read the entire study here. https://eml.berkeley.edu//~moretti/growth.pdf

Chang-TaiHsieh of the University of Chicago seeks to quantify the cost of these anti-competitive practices -- and they appear to be huge.

We quantify the amount of spatial misallocation of labor across US cities and its aggregate costs. Misallocation arises because high productivity cities like New York and the San Francisco Bay Area have adopted stringent restrictions to new housing supply, effectively limiting the number of workers who have access to such high productivity. Using a spatial equilibrium model and data from 220 metropolitan areas we find that these constraints lowered aggregate US growth by more than 50% from 1964 to 2009.

So while politicians gnash their teeth around strategies to get growth up a percent or two, they are simultaneously working against that growth by employing restrictive housing policies to benefit incumbent property owners. These people who seek protection might actually be better off with higher overall levels of economic growth. But the politicians might not be and, after all, aren't they why government exists?

Tuesday, May 16, 2017

Cuomo's Low IQ (Insurance Quotient)

The State of New York wants to ban the use of occupation or education in rating auto insurance premiums.

“This new protection cracks down on this unfair practice that soaks drivers for not having a college degree or a high-paying job,” Gov. Andrew Cuomo said in a news release.

As if we needed more evidence of the Governor's ignorance, let's examine this. Insurance data clearly shows that professionals such as military officers, teachers, engineers, accountants and dentists have lower claims costs than other professions. Why would you NOT want to use that information to price policies? If you ignored the information or followed the Governor's illogic, you would be overpricing policies to, say, teachers, and under-pricing policies to, say, professional athletes. You would sell more policies to higher risk people and fewer policies to lower risk people. This violates the cardinal rule of insurance as surely as Obamacare did.

Too bad the people of New York can't buy demagogue insurance.

“This new protection cracks down on this unfair practice that soaks drivers for not having a college degree or a high-paying job,” Gov. Andrew Cuomo said in a news release.

As if we needed more evidence of the Governor's ignorance, let's examine this. Insurance data clearly shows that professionals such as military officers, teachers, engineers, accountants and dentists have lower claims costs than other professions. Why would you NOT want to use that information to price policies? If you ignored the information or followed the Governor's illogic, you would be overpricing policies to, say, teachers, and under-pricing policies to, say, professional athletes. You would sell more policies to higher risk people and fewer policies to lower risk people. This violates the cardinal rule of insurance as surely as Obamacare did.

Too bad the people of New York can't buy demagogue insurance.

Monday, May 1, 2017

A Thought Experiment for Equalitarians

Here's a thought experiment regarding the benefits of greater equality.

Imagine you are participating in a company 401k plan. Your plan has two choices for investment. (A) An investment fund run by Dick that has consistently produced an annual rate of return of 5-7%. (B) An investment fund run by Jane that has consistently produced a 2-3% annual return.

What percent of plan participants do you think will choose Dick's fund? Suppose, not illogically, that 80% of plan participants choose Dick's fun. Is this fair to Sue? Sure, Dick appears to be a more capable investor than Sue, but should Dick really get four times Sue's income for doing the same thing? Especially since it turns out that women who run investment funds attract fewer investments than those run by men?

Now suppose your company (being progressive thinkers) ordered some of the plan's participants to take money from Dick's fund and give it to Sue. Would the plan participants as a whole be better off by doing this? Would the rate of return for the plan be better or worse? Do you think anyone here (other than Sue) would think this was a good idea? How much of your retirement investment are you willing to give up so that Sue is treated with greater equality?

Why, then, is it a good idea in general to re-allocate resources from the members of society who produce high returns to those who produce lower returns. The latter, like Sue, may be nice people and work hard, but what they produce just isn't quite as valuable. Are the members of society better off in total by doing this? Would the total rate of economic growth be better by doing this? How much economic growth are you willing to give up so that the lower producers receive resources more nearly equal to high producers?

Imagine you are participating in a company 401k plan. Your plan has two choices for investment. (A) An investment fund run by Dick that has consistently produced an annual rate of return of 5-7%. (B) An investment fund run by Jane that has consistently produced a 2-3% annual return.

What percent of plan participants do you think will choose Dick's fund? Suppose, not illogically, that 80% of plan participants choose Dick's fun. Is this fair to Sue? Sure, Dick appears to be a more capable investor than Sue, but should Dick really get four times Sue's income for doing the same thing? Especially since it turns out that women who run investment funds attract fewer investments than those run by men?

Now suppose your company (being progressive thinkers) ordered some of the plan's participants to take money from Dick's fund and give it to Sue. Would the plan participants as a whole be better off by doing this? Would the rate of return for the plan be better or worse? Do you think anyone here (other than Sue) would think this was a good idea? How much of your retirement investment are you willing to give up so that Sue is treated with greater equality?

Why, then, is it a good idea in general to re-allocate resources from the members of society who produce high returns to those who produce lower returns. The latter, like Sue, may be nice people and work hard, but what they produce just isn't quite as valuable. Are the members of society better off in total by doing this? Would the total rate of economic growth be better by doing this? How much economic growth are you willing to give up so that the lower producers receive resources more nearly equal to high producers?

Friday, April 28, 2017

Really Dumb or Uneducated? Uncle Sam Wants YOU!

The Congressional Budget Office just released new data comparing the compensation received by Federal government employees to that received in the private sector. Once gain it shows that the Federal employees receive much higher compensation. What is particularly glaring is the fact that the premium varies inversely with educational level. That is, if you're not smart enough to have attended college or even graduate from high school, the government will pay you a huge premium to your market value. If you did graduate from college or -- heaven forbid -- got an advanced degree, the government is less interested in incenting you to work there.

Maybe the stereotype that government workers are dolts is grounded in fact?

Maybe the stereotype that government workers are dolts is grounded in fact?

Monday, April 17, 2017

The Irrational Response to Denied Boarding

In 2016, there were about 800 million people carried on airline flights in the US. 41,000 people were denied boarding on US Airlines. So you have a 0.005% of being denied boarding when you fly. And only one of those 41,000 people were injured. So you have a 0.000001% chance of being treated like the man on United 3411.

Yet listening to the news, you'd think that this a catastrophe of biblical proportions. Worse yet are the calls for government to DO SOMETHING. What are the odds that government will do something to actual improve a situation that affects almost nobody anyway? Reviewing the history of government regulation, what are the odds that government action will have negative effects?

The solution to all of this is (regardless of how egregious you think the problem is ) rather simple. And it involves no action on government's part.

Each time you check in for a flight, you will be asked by the carrier to declare how large a payment would be required to accept denied boarding. Feel free to name any number. $500? $10 million? It's your choice. Anyone who is denied boarding and paid his bid price can hardly claim he has been abused. And if they have to drag you off the plane, you have nobody to blame but yourself.

Why do Americans (some of whom are intelligent enough to know better) routinely cry out for government to right every wrong? Especially those wrongs that are infinitesimal in consequence.

GET A GRIP AMERICA!

Yet listening to the news, you'd think that this a catastrophe of biblical proportions. Worse yet are the calls for government to DO SOMETHING. What are the odds that government will do something to actual improve a situation that affects almost nobody anyway? Reviewing the history of government regulation, what are the odds that government action will have negative effects?

The solution to all of this is (regardless of how egregious you think the problem is ) rather simple. And it involves no action on government's part.

Each time you check in for a flight, you will be asked by the carrier to declare how large a payment would be required to accept denied boarding. Feel free to name any number. $500? $10 million? It's your choice. Anyone who is denied boarding and paid his bid price can hardly claim he has been abused. And if they have to drag you off the plane, you have nobody to blame but yourself.

Why do Americans (some of whom are intelligent enough to know better) routinely cry out for government to right every wrong? Especially those wrongs that are infinitesimal in consequence.

GET A GRIP AMERICA!

Tuesday, April 11, 2017

The NY State Free Tuition Lie

Governor Andrew Cuomo in predictably duplicitous fashion has touted a"free tuition" program for some students in New York. Except that tuition isn't free. It's really a loan. There are two hidden catches,

1. Students must live in New York for four years after graduation or have to pay back the loans (works sort of like the Berlin Wall without the concrete).

2. The state already spends over a billion dollars on tuition assistance., This just adds another layer of $200 billion or so. So if you stay in New York, you'll be paying back your loan in the form of higher taxes.

3. Worse yet, only one-third of New York residents get a college degree. Which means the two-thirds that are merely high school graduates will be paying for the college degrees of the one-third that do. Sweet deal. And this from Democrats who are constantly complaining of "regressive " taxes.

1. Students must live in New York for four years after graduation or have to pay back the loans (works sort of like the Berlin Wall without the concrete).

2. The state already spends over a billion dollars on tuition assistance., This just adds another layer of $200 billion or so. So if you stay in New York, you'll be paying back your loan in the form of higher taxes.

3. Worse yet, only one-third of New York residents get a college degree. Which means the two-thirds that are merely high school graduates will be paying for the college degrees of the one-third that do. Sweet deal. And this from Democrats who are constantly complaining of "regressive " taxes.

Monday, April 3, 2017

Healthcare Cost Growth in One Chart

Why have healthcare costs grown so rapidly? One significant factor is the wild growth of administrators employed in the system to comply with the thousands up thousands of government mandates and regulations. A hospital might be able to afford a botched procedure now and then, but they clearly can't afford to have the wrong number of minority employees or use the wrong reimbursement codes.

Realities of Economic Growth

The Commerce Department just reported that economic growth during the Obama presidency averaged 1.6% annually. This was the lowest of any president's term wince World War II.

Obama bashing aside, here are the economic realities:

Reality #1: There is no way that we can create lots of jobs, continue to pay an aging population promised social security and Medicare benefits and continue to subsidize low income producing Americans without strong economic growth.

Reality #2: You cannot have strong economic growth unless businesses are able to attract investment capital from those who forecast a good return to their investment.

Reality #3: A country which is constantly imposing or threatening to impose new costs on business -- e.g. taxes, health care obligations, burdensome regulations, minimum wage laws -- cannot attract increased investment in businesses located there (want to invest in Venezuelan businesses right now?).

This is the fundamental reason growth was so low during the Obama presidency. While the long-term business outlook in the US was not as dire as in Venezuela, it's clearly been a lot gloomier than any time in recent history. Democrat's response? The beatings will continue until moral improves. The last eight years have been an approximate replay of the Jimmy Carter years. Is it possible that the Trump presidency can turn business pessimism around the way Ronald Reagan did? Reducing taxes and burdensome regulation (starting with Obamacare and overreaching labor and environmental rules) would be a start.

Obama bashing aside, here are the economic realities:

Reality #1: There is no way that we can create lots of jobs, continue to pay an aging population promised social security and Medicare benefits and continue to subsidize low income producing Americans without strong economic growth.

Reality #2: You cannot have strong economic growth unless businesses are able to attract investment capital from those who forecast a good return to their investment.

Reality #3: A country which is constantly imposing or threatening to impose new costs on business -- e.g. taxes, health care obligations, burdensome regulations, minimum wage laws -- cannot attract increased investment in businesses located there (want to invest in Venezuelan businesses right now?).

This is the fundamental reason growth was so low during the Obama presidency. While the long-term business outlook in the US was not as dire as in Venezuela, it's clearly been a lot gloomier than any time in recent history. Democrat's response? The beatings will continue until moral improves. The last eight years have been an approximate replay of the Jimmy Carter years. Is it possible that the Trump presidency can turn business pessimism around the way Ronald Reagan did? Reducing taxes and burdensome regulation (starting with Obamacare and overreaching labor and environmental rules) would be a start.

Thursday, March 30, 2017

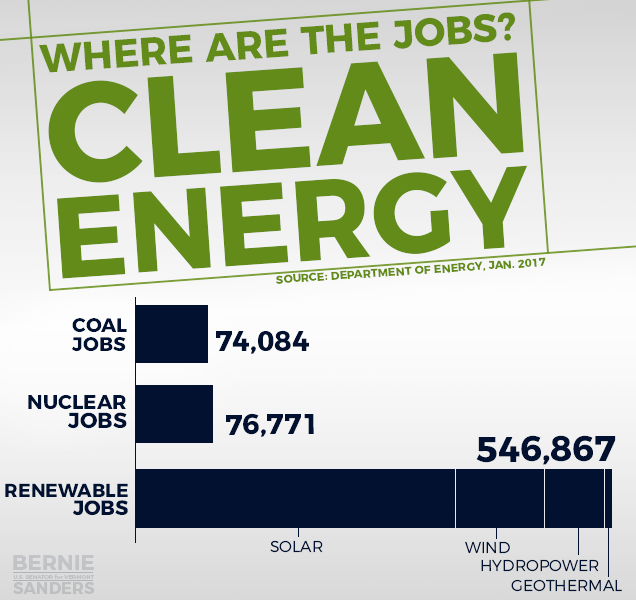

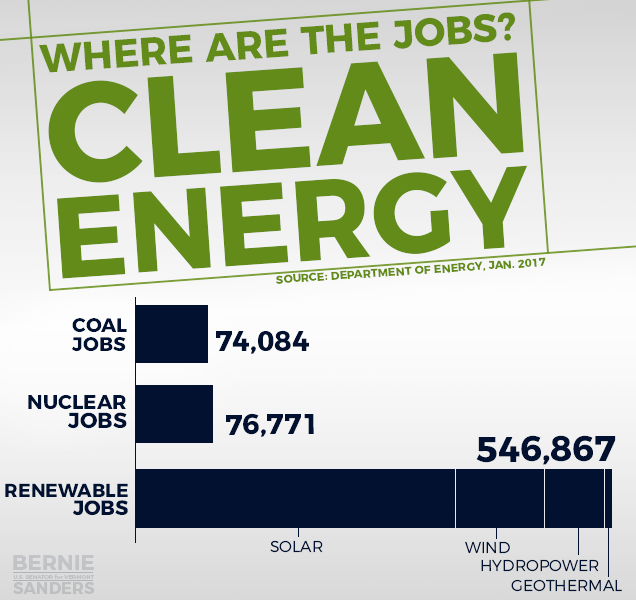

Bernie Sanders (Unwittingly) Makes the Case AGAINST Renewable Energy

This from Bernie Sanders' Facebook page (hat tip to John Murphy for saving me the embarrassment of going there).

Poor Bernie. He's just made the case against renewable energy.

The average worker in coal produces 2.1e^11 BTU. The average nuclear worker produces 1.1e^11 BTU. The average renewable worker produces 1.8e^10 BTU. That means the average coal worker is 1033.92% more efficient than the average renewable worker! We’d need to put in approximately 10x the number of labor resources into renewables as coal to get the exact same results!

And, Bernie, think of all the jobs there would be if all our electricity were generated by people on those generator bicycles!

Save this for the next time (which will probably be later today) you think there is some wacky thinking coming out of the White House. It could have been worse.

Poor Bernie. He's just made the case against renewable energy.

The average worker in coal produces 2.1e^11 BTU. The average nuclear worker produces 1.1e^11 BTU. The average renewable worker produces 1.8e^10 BTU. That means the average coal worker is 1033.92% more efficient than the average renewable worker! We’d need to put in approximately 10x the number of labor resources into renewables as coal to get the exact same results!

And, Bernie, think of all the jobs there would be if all our electricity were generated by people on those generator bicycles!

Save this for the next time (which will probably be later today) you think there is some wacky thinking coming out of the White House. It could have been worse.

Wednesday, March 29, 2017

Obamacare Will Implode Sooner Rather Than Later

The deadline for insurance companies filing for the 2018 Obamacare exchanges is June 22nd. Several large insurers, including UnitedHealth and Aetna have already decided to cut their losses. Once the Trump administration stops subsidies to the insurance companies, more will drop out and those that decide to stay will need to file large premium increases. At that point, what do Democrats do? This is their creation. They can work with Republicans to produce something acceptable to both. Or they can continue to hold back votes in hopes that . . . what? Republicans will authorize new massive subsidies to insurers?

Monday, March 27, 2017

A Protectionist Fable

A farmer in rural Iowa says to his wife, "My love: I will

take our corn to market, and from the proceeds I will buy our daughter a

dress!" So, he loads up his truck with his corn (which was

grown with the sweat of his brow) and takes it to Iowa City. He

enters the market and a Frenchman says:

"Sir! How fine it is to see you! I have just

what you are looking for. I have this collection of fine dresses from

Paris. If you give me your corn, I can sell you four dresses for your

lovely daughter."

A Bostonian then approaches the farmer and says: "I will

give you two dresses for your corn."

The farmer considers both offers and decides to deal with the

Frenchman.

"Wait!" says the custom officer. "Do not

buy those four dresses from Europe. My orders are to keep you from buying

French goods. Rather, for the same price, you can buy these two dresses

from Boston. You, and our nation, will be better for it. Surely you

can see America will be worse off if you get the four dresses rather than the

two."

"Two dresses for the same price as the four? How will

such a deal make me wealthier?"

"Oh, I can't answer that question!" says the customs

official. "But it is a fact; for all our secretaries and

department heads and legislators and journalists agree that the more a nation

receives for its goods, the poorer it becomes."

And so the farmer

deals with the Bostonian, but he (and everyone else) is left wondering why a

person is ruined receiving four dresses instead of two(Thanks to John Murphy)

Thursday, March 23, 2017

Our Idiotic Tax Payment System

Joe Bankman, a law professor at Stanford, explains the "logic" of our income tax.

"Imagine if you had to pay your credit card bill the way you pay your taxes.

Each month, Visa would send you a blank form. The form would instruct you to gather all your receipts, write down every purchase you had made, and calculate the total amount you owed Visa.

After you sent in your bill, Visa would check its records. If you’d forgotten a receipt and underpaid, Visa would fine you. If you’d made a big enough mistake, you’d go to jail."

I would just add that in this example the cost of paying your Visa bill this way would be about 20 cents per dollar of purchases.

The United States is the only wealthy country in the world that forces its taxpayers to gather up tax forms and calculate their own bill. It exists because the tax compliance industry and government both benefit from the system. At your expense.

Friday, March 17, 2017

Third Party Payments are Why Healthcare Costs Are So High

Mark Perry at AEI posts this chart showing how little of health care costs are now paid for by the people receiving the service. Is it any wonder that prices would be rising rapidly when we have almost totally removed incentives for consumers to monitor prices and control usage.

What do you think would happen to the cost of food if people only paid directly for 10% of the cost of what they ate?

What do you think would happen to the cost of food if people only paid directly for 10% of the cost of what they ate?

Thursday, March 16, 2017

The Economics of Wall Building

The National Academies of Sciences, Engineering and Medicine (NAS) estimates that the average cost to taxpayers of an illegal immigrant is $75,000 -- taking into account taxes paid and the cost of providing benefits such as education and health care. The estimated cost of completing the Southern border wall is around $20 Billion. Mathematically that means that if the wall prevents only 260,000 illegals from entering the country it will have a positive ROI.

Since Trump was elected, the number of illegal border crossings has dropped significantly (some estimates suggest a 50% reduction) just in response to the threat of building the wall and stricter enforcement of existing immigration law. It seems rather likely that The Wall could be one of those rare government expenditures with a positive return on the investment.

Wednesday, March 15, 2017

Obvious and Non-Obvious Facts About GOP Health Plan

First the obvious. If you listen to the headlines (and don't dig through the facts) you're probably under the impression that the GOP alternative to Obamacare would result in millions of people being left "uncovered" by a health plan (the CBO estimates 14 million). Why is that? It's because 14 million people who are currently forced by law to buy a health plan, will no longer buy one when they are given a choice. If you were forced to participate in your employer's retirement plan and the employer then gave you the option to opt out, would you complain that those who made that choice were "left uncovered by the employer"? This should be obvious, so I have to presume the media is not pointing this out with malice aforethought.

But there is a less obvious issue. The GOP plan results in almost $900 Billion in tax and spending savings. Now let's presume for a moment (against all historical experience) that the CBO estimate of 14 million fewer people opting for insurance is accurate. That implies that there are savings of over $60,000 per person left "uncovered" as a result of this change. Do you think we could buy a basic healthcare insurance plan to these people for less than $60,000 in premiums? This highlights not only the inefficiency of Obamacare, but also the fact that the purpose of Obamacare was never to economically provide health insurance to the uninsured. It was to give government a toehold toward taking over the entire industry. Even if the cost of doing so is catastrophically high. Even if people have to lose their doctor and pay higher premiums. To a progressive, that's just collateral damage.

But there is a less obvious issue. The GOP plan results in almost $900 Billion in tax and spending savings. Now let's presume for a moment (against all historical experience) that the CBO estimate of 14 million fewer people opting for insurance is accurate. That implies that there are savings of over $60,000 per person left "uncovered" as a result of this change. Do you think we could buy a basic healthcare insurance plan to these people for less than $60,000 in premiums? This highlights not only the inefficiency of Obamacare, but also the fact that the purpose of Obamacare was never to economically provide health insurance to the uninsured. It was to give government a toehold toward taking over the entire industry. Even if the cost of doing so is catastrophically high. Even if people have to lose their doctor and pay higher premiums. To a progressive, that's just collateral damage.

Tuesday, March 7, 2017

Asian Privilege

Wednesday, March 1, 2017

Philly Soda Tax Fizzles -- Just as You'd Expect

From the Washington Tines:

A newly imposed tax on sugary drinks sold within Philadelphia likely earned a fraction of the revenue its advocates had expected, city officials said Tuesday.

Philly had hoped that the 1.5 cent-per-ounce tax on sodas and other sweetened drinks would reap about $7.6 million each month for City Hall upon taking effect Jan. 1. According to preliminary data, however, the levy earned the city a measly $2.3 million during its first month on the books, or only 30 percent of what was expected, local media reported Tuesday.

Grocery stores and wholesalers alike now say they’re weighing potential layoffs to make up for lost profits attributed on the excise.

“People didn’t change what they drink,” the CEO of Brown’s Super Stores told the Philadelphia Inquirer. “They changed where they’re buying it.”

Jeff Brown, the owner of six ShopRite grocery stores within city limits, said beverage sales slipped 50 percent from Jan. 1 to Feb. 17 over the previous year’s figures, and cited a 15 percent overall dip in sales at city stores. As a result, according to Mr. Brown, he’s already eliminated about 280 jobs and is eyeing additional layoffs in the coming months.

This lesson, of course will not get to the Seattle City Council, which has proposed leaping off the same bridge. Nor will the Council stop to think about what a tax on labor (aka the $15 minimum wage) is doing to demand for labor in the City of Seattle. Nope. Seattle will continue to be a Sanctuary City for the Economically Ignorant.

A newly imposed tax on sugary drinks sold within Philadelphia likely earned a fraction of the revenue its advocates had expected, city officials said Tuesday.

Philly had hoped that the 1.5 cent-per-ounce tax on sodas and other sweetened drinks would reap about $7.6 million each month for City Hall upon taking effect Jan. 1. According to preliminary data, however, the levy earned the city a measly $2.3 million during its first month on the books, or only 30 percent of what was expected, local media reported Tuesday.

Grocery stores and wholesalers alike now say they’re weighing potential layoffs to make up for lost profits attributed on the excise.

Jeff Brown, the owner of six ShopRite grocery stores within city limits, said beverage sales slipped 50 percent from Jan. 1 to Feb. 17 over the previous year’s figures, and cited a 15 percent overall dip in sales at city stores. As a result, according to Mr. Brown, he’s already eliminated about 280 jobs and is eyeing additional layoffs in the coming months.

This lesson, of course will not get to the Seattle City Council, which has proposed leaping off the same bridge. Nor will the Council stop to think about what a tax on labor (aka the $15 minimum wage) is doing to demand for labor in the City of Seattle. Nope. Seattle will continue to be a Sanctuary City for the Economically Ignorant.

Friday, February 10, 2017

The 180 on Parental Choice By Senator Warren

About ten years ago I read a very well done book by, then Harvard Law professor Elizabeth Warren entitled The Two-Income Trap: Why Middle-Class Parents Are (Still) Going Broke” (2003) by Elizabeth Warren and Amelia Warren Tyagi.

Any policy that loosens the ironclad relationship between location-location-location and school-school-school would eliminate the need for parents to pay an inflated price for a home just because it happens to lie within the boundaries of a desirable school district.

A well-designed voucher program would fit the bill neatly. A taxpayer-funded voucher that paid the entire cost of educating a child (not just a partial subsidy) would open a range of opportunities to all children. . . . Fully funded vouchers would relieve parents from the terrible choice of leaving their kids in lousy schools or bankrupting themselves to escape those schools.

We recognize that the term “voucher” has become a dirty word in many educational circles. The reason is straightforward: The current debate over vouchers is framed as a public-versus-private rift, with vouchers denounced for draining off much-needed funds from public schools. The fear is that partial-subsidy vouchers provide a boost so that better-off parents can opt out of a failing public school system, while the other children are left behind.

But the public-versus-private competition misses the central point. The problem is not vouchers; the problem is parental choice. Under current voucher schemes, children who do not use the vouchers are still assigned to public schools based on their zip codes. This means that in the overwhelming majority of cases, a bureaucrat picks the child’s school, not a parent. The only way for parents to exercise any choice is to buy a different home—which is exactly how the bidding wars started.

Short of buying a new home, parents currently have only one way to escape a failing public school: Send the kids to private school. But there is another alternative, one that would keep much-needed tax dollars inside the public school system while still reaping the advantages offered by a voucher program. Local governments could enact meaningful reform by enabling parents to choose from among all the public schools in a locale, with no presumptive assignment based on neighborhood. Under a public school voucher program, parents, not bureaucrats, would have the power to pick schools for their children—and to choose which schools would get their children’s vouchers.

Below is an excerpt from that book which makes a great deal of sense. Unfortunately, since the time she wrote it, now Senator Warren has discovered the money train provided by the teacher's unions. As a result she has completely reversed her opinion of parental choice in schools. There are only two possibilities here:

1. Being elected to office removes rational thinking from your skill set.

2. Senator Warren (who once claimed to have American Indian heritage in order to enhance her employment possibilities) has always been a hypocrite.

Not sure which is the more flattering choice.

Any policy that loosens the ironclad relationship between location-location-location and school-school-school would eliminate the need for parents to pay an inflated price for a home just because it happens to lie within the boundaries of a desirable school district.

A well-designed voucher program would fit the bill neatly. A taxpayer-funded voucher that paid the entire cost of educating a child (not just a partial subsidy) would open a range of opportunities to all children. . . . Fully funded vouchers would relieve parents from the terrible choice of leaving their kids in lousy schools or bankrupting themselves to escape those schools.

But the public-versus-private competition misses the central point. The problem is not vouchers; the problem is parental choice. Under current voucher schemes, children who do not use the vouchers are still assigned to public schools based on their zip codes. This means that in the overwhelming majority of cases, a bureaucrat picks the child’s school, not a parent. The only way for parents to exercise any choice is to buy a different home—which is exactly how the bidding wars started.

Short of buying a new home, parents currently have only one way to escape a failing public school: Send the kids to private school. But there is another alternative, one that would keep much-needed tax dollars inside the public school system while still reaping the advantages offered by a voucher program. Local governments could enact meaningful reform by enabling parents to choose from among all the public schools in a locale, with no presumptive assignment based on neighborhood. Under a public school voucher program, parents, not bureaucrats, would have the power to pick schools for their children—and to choose which schools would get their children’s vouchers.

Monday, February 6, 2017

Median HH Income is Stagnant, but NOT for the Reasons You've Been Told

Mark Perry at U of Michigan created this very interesting chart. Yes, median household income has not been growing for the last 15 years. You've heard that. But real hourly compensation has been growing steadily. Mathematically this can only happen if the median number of hours worked per household fell. There are several possibilities which would contribute to this:

1. Employed people are working fewer hours. We know that Obamacare caused many jobs to become part-time rather than full time. People may also be voluntarily reducing

2. There are fewer people employed per household. We know that household size has been steadily decreasing for some time. If a working couple divorces, the number of hours worked per household (now 2 instead of 1) drops as does the medium income per household.

3. The percent of the workforce that is employed continues to drop year after year. That results in fewer hours worked per household.

The bottom line is that when the media and politicians shout that the "median household income is falling" it is not because people are being paid less to work. There is just a lot less work being done in the average household.

1. Employed people are working fewer hours. We know that Obamacare caused many jobs to become part-time rather than full time. People may also be voluntarily reducing

2. There are fewer people employed per household. We know that household size has been steadily decreasing for some time. If a working couple divorces, the number of hours worked per household (now 2 instead of 1) drops as does the medium income per household.

3. The percent of the workforce that is employed continues to drop year after year. That results in fewer hours worked per household.

The bottom line is that when the media and politicians shout that the "median household income is falling" it is not because people are being paid less to work. There is just a lot less work being done in the average household.

Sunday, January 22, 2017

The Answer to Failing Schools is More Money?

According to the most recent report from the National Center for Education Statistics, the amount of money (in real dollars) spent on educating K-12 students is almost 4 times today what it was 50 years ago. Yet the quality of education has not improved and by many measures has declined. What are the odds that the remedy for this is spending even more money on the same education? If your Ford dealer told you that the best solution for a car that didn't run well was to spend ever more money on it, would you? Or would you perhaps try something different? And how would you feel if government told you that if you did try something else, you'd have to keep paying ever more money to that Ford dealer?

Total and current expenditures* per pupil in public elementary and secondary schools

1920 $ 598

1930 1251

1940 1562

1950 2325

1960 3568

1970 5546

1980 7027

1990 9705

2000 11302

2014 12509

*Constant 2015-16 Dollars

Total and current expenditures* per pupil in public elementary and secondary schools

1920 $ 598

1930 1251

1940 1562

1950 2325

1960 3568

1970 5546

1980 7027

1990 9705

2000 11302

2014 12509

*Constant 2015-16 Dollars

Friday, January 20, 2017

Oxfam Blames the Wealthy for Poverty

Oxfam (a UK based charity whose mission is "fight poverty") recently sent out this appeal (see below) in which they imply that poverty is caused by businessmen who are wildly successful. They are repeating the falsehood that wealth is a zero sum game -- that the less successful would be wealthier if, somehow , the really successful were less so.

The fact of the matter is that the number of people who are desperately poor (living on $1/day) has been declining steadily and significantly over the last fifty years -- i.e. the time frame over which all the wealthy people whom Oxfam disparages accumulated their wealth. The poor have become less poor precisely because of that wealth creation. Bill Gates wealth via Microsoft is not the reason the poor are poor; it is why they are less poor. Mr. Gates did far more for the world's poor by making Microsoft a success than he will ever do with his foundation (and the two are non mutually exclusive).

Oxfam's sloppy thinking (I'm being generous here) is deplorable.

The fact of the matter is that the number of people who are desperately poor (living on $1/day) has been declining steadily and significantly over the last fifty years -- i.e. the time frame over which all the wealthy people whom Oxfam disparages accumulated their wealth. The poor have become less poor precisely because of that wealth creation. Bill Gates wealth via Microsoft is not the reason the poor are poor; it is why they are less poor. Mr. Gates did far more for the world's poor by making Microsoft a success than he will ever do with his foundation (and the two are non mutually exclusive).

Oxfam's sloppy thinking (I'm being generous here) is deplorable.

|

|||||||||||||||

| Have you seen

the news this week that just

8 men own as much wealth as the poorest half of the world's

population? This news comes after the release of our new report "An

economy for the 99%". Here at home and across the world, millions of ordinary people have been left behind by an economy for the 1%. We must take urgent action to reverse dangerous inequality – not accelerate it. The poorest people in our societies have been hit hardest – particularly women who suffer high levels of economic discrimination, work in the lowest paid jobs, and take on the lion's share of unpaid care work. Read more about staggering inequality and how you can take action >> |

|||||||||||||||

Tuesday, January 10, 2017

The Real World (not Obama's World) Will Continue to Run on Fossil Fuels

While President Obama was sitting in his office contemplating Utopian worlds powered by wind and solar power, his Energy Department was contemplating the real world in their Annual Energy Outlook Report.

Saturday, January 7, 2017

Global Warming Data for the Rest of Us

I realize that the case for Global Warming is based on "complex models" that nobody but the most sophisticated climatologists can understand, but . . .

don't you think the above chart makes it a little harder to join the "question is settled" crowd? Don't you think that the news media getting excited over one of these oscillating spikes is a bit naïve? As a statistician, this data looks pretty random around a zero mean to me.

don't you think the above chart makes it a little harder to join the "question is settled" crowd? Don't you think that the news media getting excited over one of these oscillating spikes is a bit naïve? As a statistician, this data looks pretty random around a zero mean to me.

Thursday, January 5, 2017

Minimum Wage Insanity

I eat often at a breakfast spot in Arizona I like very much. They employ about ten people. Most of them make minimum wage (plus tips). This year they may face an increased cost of close to $40,000 in their labor costs. I doubt if this restaurant clears more than $100,000 in net profit. What do you think they will do in the face of a 25% increase in labor costs? How do the people who impose these costs by legislation expect small businesses to manage? This is pure insanity.

Subscribe to:

Comments (Atom)