Amidst all the whining about inequality of income distribution, a huge inequality goes virtually unmentioned. In fact, it's actually endorsed by our cultural and government leaders.

Married couples with children have an average income of $80,000. The average income for mothers with children, but no husband is $24,000.

The inverse relationship between poverty and two parent households could not be more striking. It's almost as obvious as the relationship between smoking and disease.

Hmmm. Let's look at how our country reacted to the realization that smoking was injurious. Initially, government threw it's weight -- banning cigarette advertising and printing on-pack warnings. As usual, such efforts to change ingrained human behavior were relatively ineffectual. Then we started to get smarter. We made it much more expensive to smoke (average price of a pack in the 1960s? 35 cents. Today? $5.50). The entertainment industry stopped portraying smoking as glamorous. On-camera smoking was effectively banned (Johnny Carson still tapped his cigarette box nervously, but never used it on air). PSA campaigns -- like "Smoking is Glamorous" -- became quite visible. Smokers became pariahs, targets of the righteous wrath of the non-smoker. They were banished to the sidewalks outside office buildings. What about the personal freedom to choose behaviors that might be harmful to you? Bah!

Result: Smoking incidence dropped from near 50% in the 1960s to under 20% today.

Let's contrast that with how we react to the fact that fatherless households are severely injurious to the well being of children.

Have single-parent households been removed from the TV? Hardly. They are everywhere. They are portrayed as the norm (just like smoking was in the 1950s). They are glamorized. Single mothers are portrayed as noble and heroic. Have we imposed punitive taxes on single parents? Just the opposite. If the typical single mom were married, she would lose many of her government welfare payments. Have celebrities run PSAs against single parenthood? No, they grace every tabloid cover and Entertainment Tonight show with testimonies as to how wonderful it is to raise a child without a father (and if you earn a million dollars a year, it might very well be). Have we banished single mothers to the sidewalks? No, we set up subsidized daycare centers at work to make it easier for them to remain fatherless. Are they ridiculed? No, we make up cute names for them like Baby Mama. What about the wrath of two-parent families? They are mocked as "the religious right". Bad behavior? No, just exercising my freedom to choose a lifestyle. Who are you to judge?

Result: Over just the last decade the number of two-parent households decreased by 1.2 million. Fifteen million U.S. children live without a father. In St.Louis only 40 percent of families have two parents. In Baltimore it is 38%.

There's certainly no lack of concern. Every day the media makes us look at children in poverty or those who fail in school and asks "how can we help?" But they seldom point out why such children need help in the first place. We pretty quickly got past contemplating why people smoke (Was it fun? Was it hard-wired human behavior? If your parents smoked weren't you doomed to smoke also?) and moved on to changing deleterious behavior. We stopped promoting smoking, we made it more costly, and we started socially ostracizing smokers. We didn't say "don't be so judgmental" or "just exercising my freedom of choice."

Anti-smoking efforts worked. We changed the behavior from the norm to the exception. We took it from a sign of sophistication and glamour and made it unsophisticated and dirty. We saved people's lives. We could do the same thing about fatherless families, but we haven't. Is that because the consequences are less costly? Are they?

Monday, December 31, 2012

Saturday, December 29, 2012

OF COURSE We Can Afford It!

Years ago I got some valuable insight into consumer credit behavior while doing marketing programs for the credit card industry. What I learned was that when consumers are faced with a decision as to whether to buy something on credit, they don't look at their level of indebtedness. They usually ask only one question: Can I afford the payments? This is why you see so many offers for no interest or deferred payment financing. If your monthly payment doesn't increase, OF COURSE you can afford to buy it!

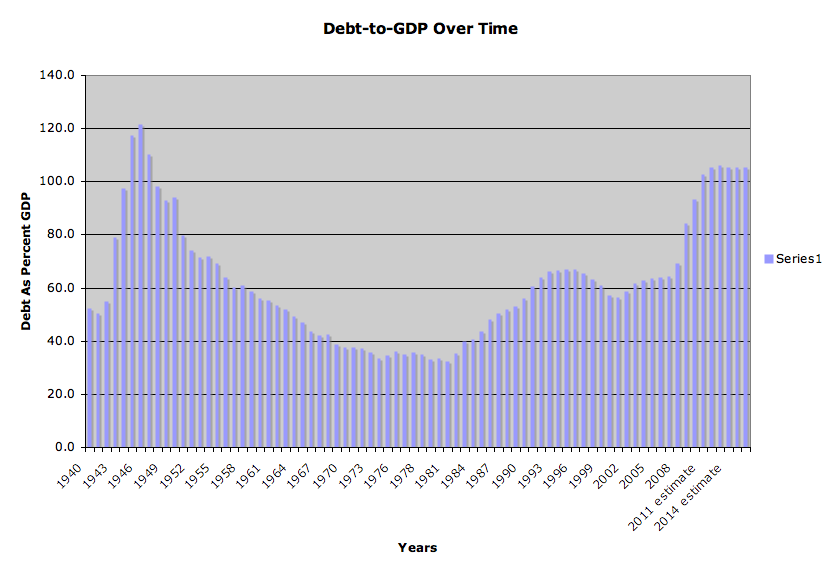

Now let's consider the US government's behavior. In 1995 the national debt was about $5 trillion and annual interest payments were about $230 billion. In 2011 the national debt had risen to $15 trillion and interest payments were about ... $230 billion. Because the Federal Reserve was creating astronomical sums of money to keep Treasury interest rates down, we tripled the national debt without paying a penny more in annual interest. OF COURSE we can afford to increase Federal spending! We can afford the payments.

But then an odd thing eventually happens. Your monthly payments DO start to increase. Maybe market rates rise. Maybe you've finally reached the point where lenders consider you a high risk and raise the rate at which they are willing to lend you more. Suddenly you CAN'T afford those monthly payments. What do you do? If you're someone of integrity and personal responsibility, you cut back your household spending and start paying down the loan. If you're not, you keep spending as much as possible and then declare bankruptcy.

What will the US Government do when its monthly payments eventually rise**? If those running our government and those who elect them have integrity, they drastically reduce government spending (I'll pause here for the reader to finish laughing). If they're not, they do what governments usually do. They debase the currency and renege on their debts. When this happens in Argentina (every 20 years or so), the worldwide consequences are manageable. When this happens to a nation that produces 25% of world GDP, the consequences are catastrophic. But remember. It's all George Bush's fault. We bear no responsibility. FORWARD!

** Today the Federal Reserve buys more than two-thirds of all US treasury debt issued. What does that mean? Its means that there are few buyers for those bonds at the offered interest rate.

Now let's consider the US government's behavior. In 1995 the national debt was about $5 trillion and annual interest payments were about $230 billion. In 2011 the national debt had risen to $15 trillion and interest payments were about ... $230 billion. Because the Federal Reserve was creating astronomical sums of money to keep Treasury interest rates down, we tripled the national debt without paying a penny more in annual interest. OF COURSE we can afford to increase Federal spending! We can afford the payments.

But then an odd thing eventually happens. Your monthly payments DO start to increase. Maybe market rates rise. Maybe you've finally reached the point where lenders consider you a high risk and raise the rate at which they are willing to lend you more. Suddenly you CAN'T afford those monthly payments. What do you do? If you're someone of integrity and personal responsibility, you cut back your household spending and start paying down the loan. If you're not, you keep spending as much as possible and then declare bankruptcy.

What will the US Government do when its monthly payments eventually rise**? If those running our government and those who elect them have integrity, they drastically reduce government spending (I'll pause here for the reader to finish laughing). If they're not, they do what governments usually do. They debase the currency and renege on their debts. When this happens in Argentina (every 20 years or so), the worldwide consequences are manageable. When this happens to a nation that produces 25% of world GDP, the consequences are catastrophic. But remember. It's all George Bush's fault. We bear no responsibility. FORWARD!

** Today the Federal Reserve buys more than two-thirds of all US treasury debt issued. What does that mean? Its means that there are few buyers for those bonds at the offered interest rate.

Friday, December 28, 2012

The Price of Milk

Nolan Finley, in his Detroit News column, wonders what would happen if milk were priced on the same basis as the federal government uses to structure income taxes.

The average price of milk is $2.49/gallon, so everyone (ignoring for a moment the 47 million people on Food Stamps) now pays $2.49. But if the government applied it's unique way of thinking here, 40 percent of the public wouldn't pay a dime for it. In fact, the government would actually PAY them $1 for every gallon of milk they took home. At the other extreme, 1 percent of the public would be charged $109.81 per gallon for milk. Of course, these people would buy a lot less milk at that price, and most of the scheme would need to be financed by issuing milk bonds to China.

The current tax system is, indeed, unfair, but not because the wealthy don't pay enough.The Rich are paying more for their government milk than it's worth so that most others can pay less. Instead of saying thank you, we're trying to milk them dry.

The average price of milk is $2.49/gallon, so everyone (ignoring for a moment the 47 million people on Food Stamps) now pays $2.49. But if the government applied it's unique way of thinking here, 40 percent of the public wouldn't pay a dime for it. In fact, the government would actually PAY them $1 for every gallon of milk they took home. At the other extreme, 1 percent of the public would be charged $109.81 per gallon for milk. Of course, these people would buy a lot less milk at that price, and most of the scheme would need to be financed by issuing milk bonds to China.

The current tax system is, indeed, unfair, but not because the wealthy don't pay enough.The Rich are paying more for their government milk than it's worth so that most others can pay less. Instead of saying thank you, we're trying to milk them dry.

Friday, December 21, 2012

The Future in Four Charts

An economy where fewer and fewer people work . . .

to support more and more dependents . . .

on ever increasing levels of government spending . . .

financed by growing levels of debt . . .

is not one conducive to high levels of growth.

Subscribe to:

Posts (Atom)