Monday, November 23, 2015

Federal Government Is Big Source of Income Inequality

Chris Edwards at the Cato institute points out that the average Federal government worker's compensation is almost 80% higher than the average worker in the private sector. In fact just last year the VA Administration handed out over $140MM in bonuses (and they say that incompetence doesn't pay!). The next time you hear Bernie Sanders or Hillary complain about income inequality, can we have a discussion of the Federal government's rule in that?

Friday, November 20, 2015

A Refresher on Marginal Tax Rates and Revenue

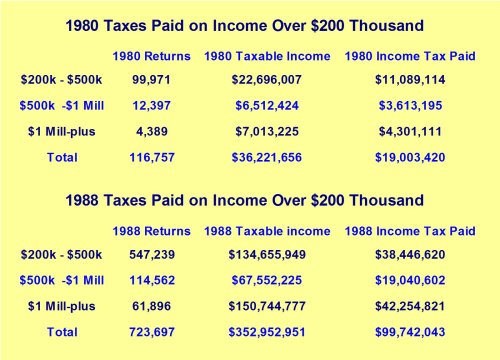

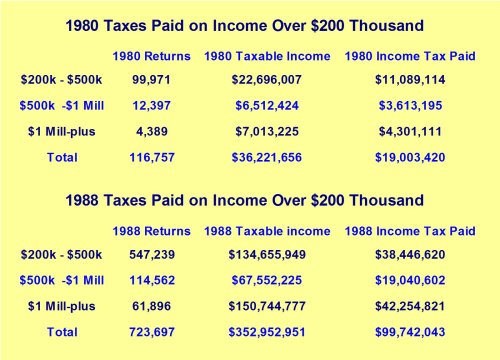

I'm pretty sure Bernie Sanders and Hillary Clinton were alive during the 1980s, so this shouldn't be necessary. But just as a refresher to them (and to those who weren't around then), let's review. In 1980, the top marginal tax rate was 70%. A few years later, Congress reduced the top rate to 28%. The chart below shows what happened to Federal Income Tax revenue from those in the top tax brackets. These aren't opinions; they're hard facts.

Now Bernie and Hillary are stumping to raise rates back to the high levels of 1980. To what end? To reduce the amount of tax the government collects? To reduce the number of people reporting high incomes? To prove, once again, that the Laffer Curve is quite real?

Now Bernie and Hillary are stumping to raise rates back to the high levels of 1980. To what end? To reduce the amount of tax the government collects? To reduce the number of people reporting high incomes? To prove, once again, that the Laffer Curve is quite real?

Wednesday, November 18, 2015

The Effect of Competition in ETFs

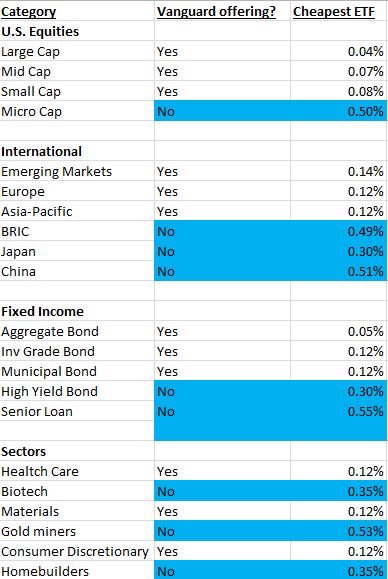

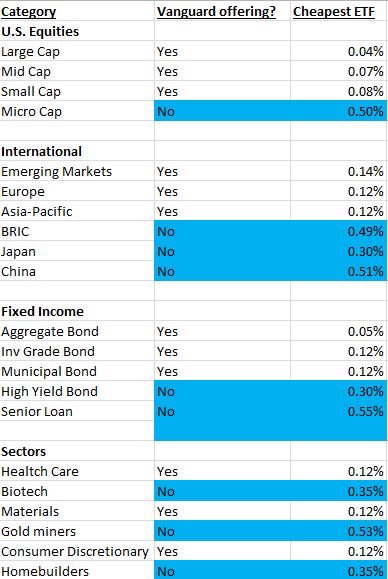

Eric Blachunas at Boomberg in one chart shows the effect of competition on Exchange Traded Funds. Management fees are much lower in the categories in which Vanguard (the low cost provider in mutual finds and ETFs) has an offering.

Is it any wonder that large financial firms continue to support regulations from Congress in order to stifle competition? Where they haven't been successful (e.g. ETFs) you can see the effect quite dramatically.

Is it any wonder that large financial firms continue to support regulations from Congress in order to stifle competition? Where they haven't been successful (e.g. ETFs) you can see the effect quite dramatically.

Monday, November 16, 2015

Government Subsidies Drive Higher Prices in Education

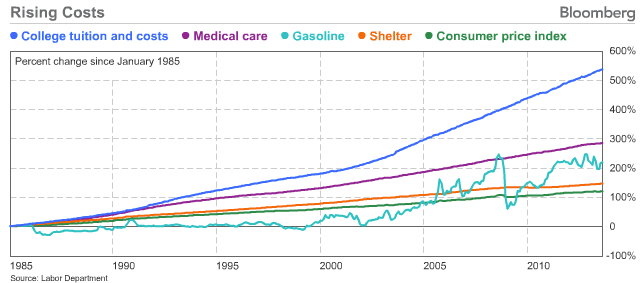

Economists (and non-economists willing to devote about 20 seconds of thought) understand that when you subsidize something the demand for it and the nominal price will both rise. For some reason, though (maybe there are just a lot of people who don't have those 20 seconds), the causal link between subsidizing college tuition and higher prices for that product hasn't sunk in. The Federal Reserve Bank of New York has published a new study which documents this perverse relationship. They conclude:

"We find a passthrough effect of Pell Grants and subsidized loans on sticker price tuition of about 55 and 65 cents on the dollar, respectively."

This is obviously a vicious cycle where tuition subsidies beget higher tuition, which in turn leads to calls for even greater subsidies. This may be exactly what the Democrat party wants, but it's clearly not in the best interests of the public.

It is no coincidence that the product categories with the highest rates of price increases are the ones that are most heavily subsidize -- i.e. tuition and medical purchases.

"We find a passthrough effect of Pell Grants and subsidized loans on sticker price tuition of about 55 and 65 cents on the dollar, respectively."

This is obviously a vicious cycle where tuition subsidies beget higher tuition, which in turn leads to calls for even greater subsidies. This may be exactly what the Democrat party wants, but it's clearly not in the best interests of the public.

It is no coincidence that the product categories with the highest rates of price increases are the ones that are most heavily subsidize -- i.e. tuition and medical purchases.

Monday, November 9, 2015

A Tale of Two Tickets -- Opportunity Cost and Climate Alarm.

John and Ted, two brothers, are big NFL football fans. Tickets to the Super Bowl are going for $5000 each on StubHub and Ebay. Suddenly they win two tickets to the SuperBowl in a raffle. John says to Ted, "We can't afford to pay $10,000 to go to the Super Bowl." Ted replies to John, "But we're not spending $10,000. We got the tickets for free." Discuss.

If you're an economist, the answer to this seems pretty obvious. If you're a politician, or a member of the general public, it isn't. But it illustrates an underlying problem in the political process -- namely, opportunity cost. The cost of those "free" tickets really is $10,000 for the simple reason that you could sell those tickets and use the $10,000 for something else. If you really would spend $10,000 for Super Bowl tickets, you're fine, but the fact that you already have them in hand is irrelevant.

This is the fundamental illogic that Bjørn Lomborg points out about Global Warming activists. Given that resources are not unlimited, if you spend $10 Trillion trying to change the climate, is the benefit of that greater than how else you could spend $10 Trillion? It's pretty clear from his analysis that it's not.

Every good idea is not worth doing. Because in doing that good idea you must sacrifice other ideas that may have more value. Going to the Super Bowl is a good idea for John and Ted. But is it a better idea than what else they could do with $10,000?

If you're an economist, the answer to this seems pretty obvious. If you're a politician, or a member of the general public, it isn't. But it illustrates an underlying problem in the political process -- namely, opportunity cost. The cost of those "free" tickets really is $10,000 for the simple reason that you could sell those tickets and use the $10,000 for something else. If you really would spend $10,000 for Super Bowl tickets, you're fine, but the fact that you already have them in hand is irrelevant.

This is the fundamental illogic that Bjørn Lomborg points out about Global Warming activists. Given that resources are not unlimited, if you spend $10 Trillion trying to change the climate, is the benefit of that greater than how else you could spend $10 Trillion? It's pretty clear from his analysis that it's not.

Every good idea is not worth doing. Because in doing that good idea you must sacrifice other ideas that may have more value. Going to the Super Bowl is a good idea for John and Ted. But is it a better idea than what else they could do with $10,000?

Thursday, November 5, 2015

Without State Coercion Workers Opt Out of Unions

In 2001 the Washington State legislature declared that self-employed home health care workers (the sort that come in and care for you when you're ill) were effectively state employees because some of their customers were Medicaid recipients. Hence they were required to join and pay dues to the Service Employees International Union whether they wanted to or not. Because the SEIU funnels money to Democrats in the legislature it's pretty obvious why they did this. In June, 2104, the Supreme Court struck down this arrangement. Here's what's happened since.

August 2014 August 2015

Child Care Providers 6633 7103

SEIU Union Members 6633 3451

% Opting to Be Unionized 100% 48%

Within a year of being freed of the state coercion to belong to a union, half of them have opted out.

This is very reminiscent of East Germany needing to build a wall to keep people from fleeing the "workers paradise" they had created.

August 2014 August 2015

Child Care Providers 6633 7103

SEIU Union Members 6633 3451

% Opting to Be Unionized 100% 48%

Within a year of being freed of the state coercion to belong to a union, half of them have opted out.

This is very reminiscent of East Germany needing to build a wall to keep people from fleeing the "workers paradise" they had created.

Subscribe to:

Posts (Atom)