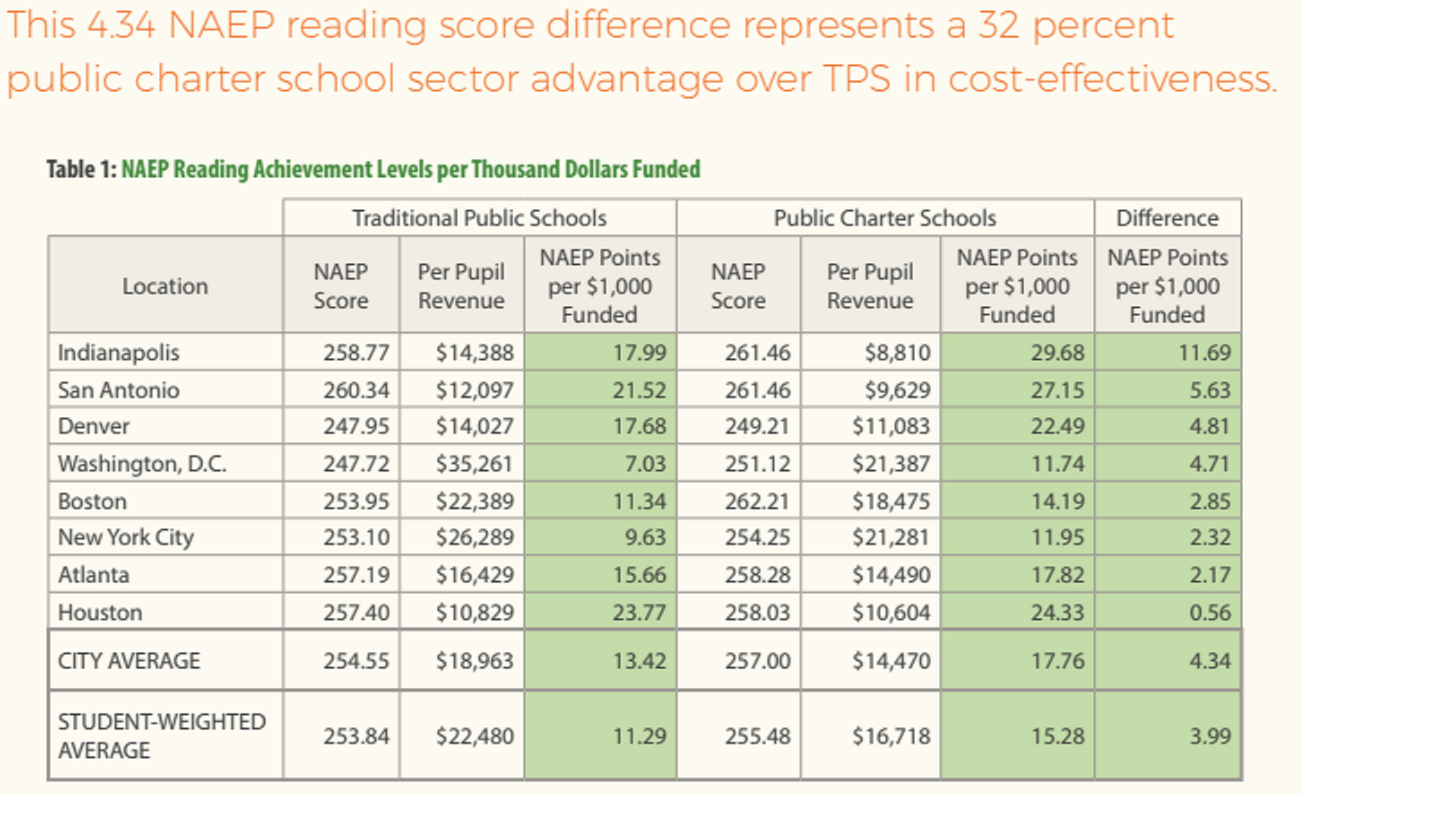

A new study from CATO and the University of Arkansas examines student performance at charter schools and traditional schools in eight major U.S. cities, Washington D.C., Indianapolis, Boston, Denver, San Antonio, New York City, Atlanta, and Houston. These researchers also conducted a return-on-investment (ROI) analysis, comparing projected lifetime earnings of charter school students with those of traditional school students, relative to the cost to taxpayers. Their conclusion? They show public charter schools are delivering better results for students at significantly lower costs to taxpayers.

Yet the education establishment routinely opposes charter schools. Not surprising if your objective has more to do with employing people than educating students.