Thursday, February 13, 2014

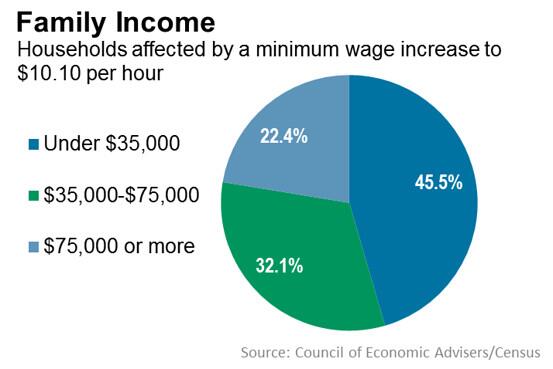

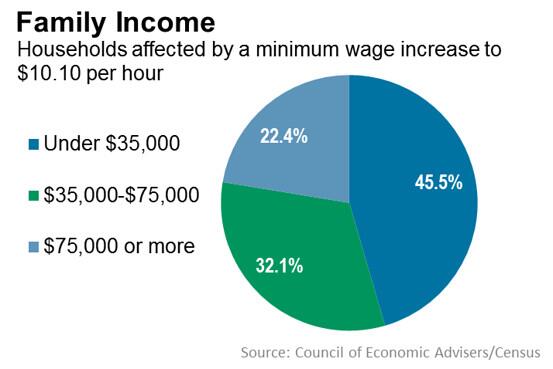

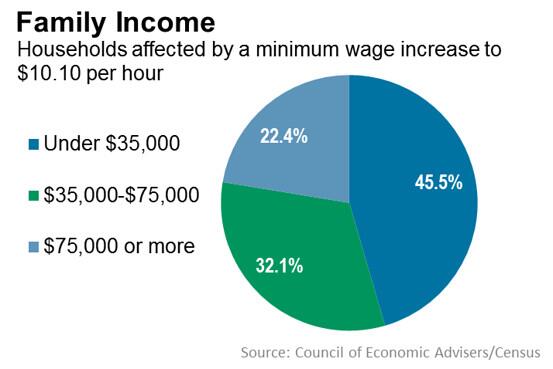

Minimum Wage Is Not For the Poor

The average household income of someone earning minimum wage is over $50,000.

Tuesday, February 11, 2014

Obamacare's Dramatic Effect on Hours Worked

The chart below shows how the average workweek has changed in lower-wage industries. Let's see now, what could possibly have happened that would cause employers to reduce the number of hours that they allowed people to work? Hmmm. Wait. It'll come to me.

Government Urges People To Gamble Away Their Retirement

Every week most of us hear the exhortations from our state governments to buy lottery tickets. The average lottery player spends about $150 per month in the US and ranges from $46 in North Dakota to almost $900 in Massachusetts. Participation in lotteries is heavily skewed to low income households -- i.e. the ones that can least afford to lose their money, i.e. the ones who when they reach retirement age tell us that they have not been able to save any money.

Let's consider an alternate scenario, one in which the states exhorted these people to be prudent rather than reckless. Imagine that the average person were to put $150 per month into an IRA account. With reasonable investment return assumptions, those people would have about a half million dollars in that account after 45 years!

Government is supposed to be serving the best interests of the public. Clearly in this case they are working only to serve the best interests of government.

Let's consider an alternate scenario, one in which the states exhorted these people to be prudent rather than reckless. Imagine that the average person were to put $150 per month into an IRA account. With reasonable investment return assumptions, those people would have about a half million dollars in that account after 45 years!

Government is supposed to be serving the best interests of the public. Clearly in this case they are working only to serve the best interests of government.

Thursday, February 6, 2014

Obamacare Prevents Work. Really.

There's been a lot of smoke blowing over the report by the Congressional Budget Office that Obamacare will result in millions of fewer people working. The CBO report said that as a result of Obamacare, over 2 million people would either seek less work or leave the labor market completely. While this appears to be simple common sense anywhere outside of Washington, the President denies that this would happen. Let's look at a real example using the government's own website heatlhcare.gov.

John and Mary live in Fort Myers, Florida. They are both 60 years old and earn $63,000 per year (about $9,0000 above the median US household income) They received a cancellation notice from Blue Cross and are thinking about buying a "bronze" healthcare plan from the healthcare.gov exchange. The premium for this plan is $1109/month -- $13,308 annually. Mary wonders what would happen if she stopped working at her part time job and they lost $3000/year in income. Luckily healthcare.gov supplies the answer. They are now eligible for a government subsidy and their premium drops to $311.

Mary is not a math whiz, but even she can do this one.

Lost income due to quitting her job -$3000

Income and payroll taxes saved +$700

Healthcare premium saved +$9576

Net benefit to quitting +$7276

In other words, the government will pay Mary $7276 to quit her job and send a bill to her neighbors who are still working for over $10,000. What do you think Mary will do? Who do you believe is correct about the impact of Obamacare -- the President or the CBO?

John and Mary live in Fort Myers, Florida. They are both 60 years old and earn $63,000 per year (about $9,0000 above the median US household income) They received a cancellation notice from Blue Cross and are thinking about buying a "bronze" healthcare plan from the healthcare.gov exchange. The premium for this plan is $1109/month -- $13,308 annually. Mary wonders what would happen if she stopped working at her part time job and they lost $3000/year in income. Luckily healthcare.gov supplies the answer. They are now eligible for a government subsidy and their premium drops to $311.

Mary is not a math whiz, but even she can do this one.

Lost income due to quitting her job -$3000

Income and payroll taxes saved +$700

Healthcare premium saved +$9576

Net benefit to quitting +$7276

In other words, the government will pay Mary $7276 to quit her job and send a bill to her neighbors who are still working for over $10,000. What do you think Mary will do? Who do you believe is correct about the impact of Obamacare -- the President or the CBO?

Monday, February 3, 2014

The Great Government Mutual Fund Investment Opportuntiy

Imagine there was a new mutual fund with the following proposition. We want you to take money out of your current investments and give it to us. Here's our plan. First, we're going to impose a 20% load on your investment up front, so that you will have to take $1.20 out of your current portfolio for every dollar we invest. Then, we're going to invest your money in companies and projects that have such low return prospects that ordinary investment funds refuse to fund them.

Does that sound like something you'd be anxious to do? You're probably saying, "Why, the only way they could raise money for that fund would be to threaten to put you in jail if you didn't invest!" And you'd be right.

In fact this is a good approximation of the prospectus the Federal government should publish for it's spending operations.

1. Government raises the money it spends from taxes -- mostly income taxes. Compliance costs for administering this tax are about 20% of the revenue collected. That means that effectively the government takes $1.20 out of the economy for every $1 it plans to spend.

2. While in theory, government could spend most of it's money on things that have good economic returns, in practice it doesn't. It invests in things like Solyndra and Cash for Clunkers, but mostly it sends checks out to subsidize people who aren't producing much right now.

This is the fundamental reason why government spending is not, and really cannot be economically productive (or "stimulative") -- any more than the mutual fund we've described can produce better results than the ones in which you already invest.

Does that sound like something you'd be anxious to do? You're probably saying, "Why, the only way they could raise money for that fund would be to threaten to put you in jail if you didn't invest!" And you'd be right.

In fact this is a good approximation of the prospectus the Federal government should publish for it's spending operations.

1. Government raises the money it spends from taxes -- mostly income taxes. Compliance costs for administering this tax are about 20% of the revenue collected. That means that effectively the government takes $1.20 out of the economy for every $1 it plans to spend.

2. While in theory, government could spend most of it's money on things that have good economic returns, in practice it doesn't. It invests in things like Solyndra and Cash for Clunkers, but mostly it sends checks out to subsidize people who aren't producing much right now.

This is the fundamental reason why government spending is not, and really cannot be economically productive (or "stimulative") -- any more than the mutual fund we've described can produce better results than the ones in which you already invest.

Subscribe to:

Posts (Atom)