Tuesday, December 30, 2014

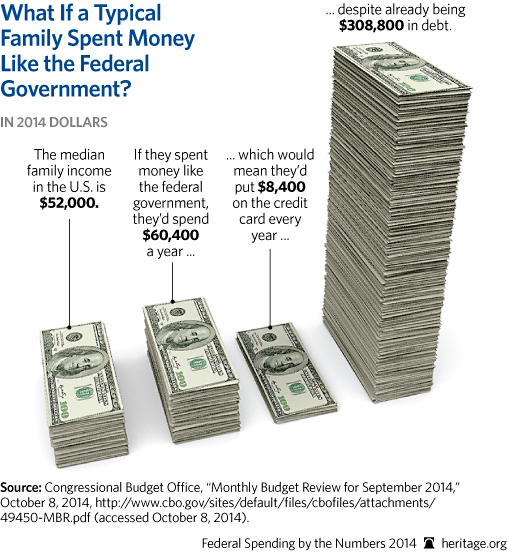

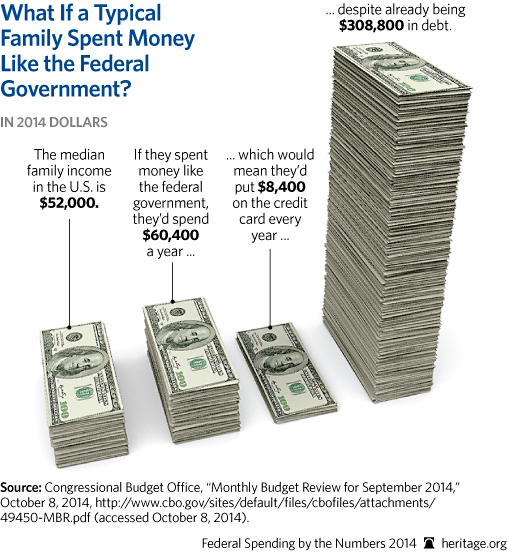

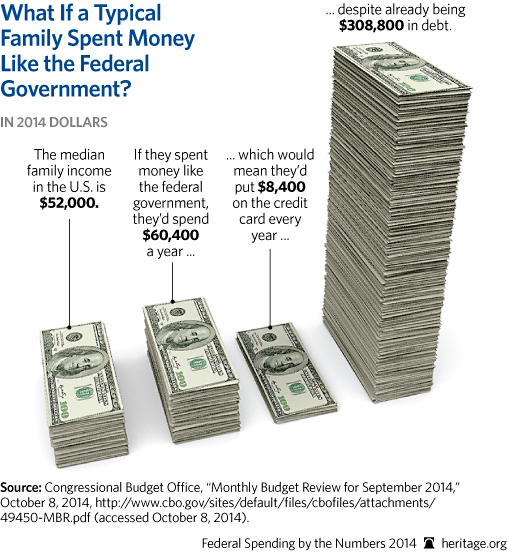

If Everyone Spent Like the Government

If you're having trouble relating to the huge numbers involved in government budgets, this chart might put it in perspective. The only thing that's misleading about this is that no lender would increase your credit line every year if you had $300,000 in unsecured debt. They would tell you to be responsible with your spending and learn to live within your means.

Tuesday, December 23, 2014

Why It's Not Realistic to "Grow Your Way Out of Debt"

You've heard it said often. It also seems to be the premise of the Federal Reserve's "quantitative easing". Debt is not all that onerous if you can grow your way out of it. This is actually a true statement. But is this a plan for the US economy or just a wish?

Total debt in the US -- government, corporate and private -- is $58 trillion.

Total GDP in the US is $18 trillion, but $6 of that is government spending -- taking money from the production of the private sector and spending it on non-productive activities like transfer payments to Social Security and Medicare. So the part of the economy that actually produces value is about $12 trillion.

Total debt in the US -- government, corporate and private -- is $58 trillion.

Total GDP in the US is $18 trillion, but $6 of that is government spending -- taking money from the production of the private sector and spending it on non-productive activities like transfer payments to Social Security and Medicare. So the part of the economy that actually produces value is about $12 trillion.

Assuming an annual interest of 2%, even if you could

restrain annual debt increases to 3% of GDP a year, the productive part of the economy

would have to grow at 5% just to stay even. When was the last time you saw the economy grow that fast for more than a quarter?

Now imagine that interest rates jumped to, say, 5% (the ten year treasury was at 5% in 2002). At that level almost a quarter of private sector GDP would have to be devoted to debt service to break even. Hardly likely. So it's pretty easy to see why the Federal Reserve keeps backing off its promise to reduce its funding and allow interest rates to rise. Where (and how) does all this end?

Subscribe to:

Posts (Atom)